Statistical Significance of the Sharpe Ratio.

SharpeR

A number of utilities for dealing with Sharpe ratio, the Sharpe ratio of the Markowitz portfolio, and, in general, overfit of trading strategies based on (in-sample) Sharpe statistics.

-- Steven E. Pav, [email protected]

Installation

This package may be installed from CRAN; the latest development version may be installed via drat, or built from github:

# install via CRAN:

install.packages("SharpeR")

# get latest dev release via drat:

if (require(drat)) {

drat:::add("shabbychef")

install.packages("SharpeR")

}

# get snapshot from github (may be buggy)

if (require(devtools)) {

install_github("shabbychef/SharpeR")

}

Basic Usage

Using sr

require(SharpeR)

# suppose you computed the Sharpe of your strategy

# to be 1.3 / sqrt(yr), based on 1200 daily

# observations. an object can be instanatiated as

# follows

my.sr <- sr(sr = 1.3, df = 1200 - 1, ope = 252, epoch = "yr")

print(my.sr)

## SR/sqrt(yr) Std. Error t value Pr(>t)

## Sharpe 1.30 0.46 2.8 0.0023 **

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

And using real data:

require(quantmod)

options(getSymbols.warning4.0 = FALSE)

# get price data, compute log returns on adjusted

# closes

get.ret <- function(sym, warnings = FALSE, ...) {

# getSymbols.yahoo will barf sometimes; do a

# trycatch

trynum <- 0

while (!exists("OHCLV") && (trynum < 7)) {

trynum <- trynum + 1

try(OHLCV <- getSymbols(sym, auto.assign = FALSE,

warnings = warnings, ...), silent = TRUE)

}

adj.names <- paste(c(sym, "Adjusted"), collapse = ".",

sep = "")

if (adj.names %in% colnames(OHLCV)) {

adj.close <- OHLCV[, adj.names]

} else {

# for DJIA from FRED, say.

adj.close <- OHLCV[, sym]

}

rm(OHLCV)

# rename it

colnames(adj.close) <- c(sym)

adj.close <- adj.close[!is.na(adj.close)]

lrets <- diff(log(adj.close))

# chop first

lrets[-1, ]

}

get.rets <- function(syms, ...) {

some.rets <- do.call("cbind", lapply(syms, get.ret,

...))

}

some.rets <- get.rets(c("IBM", "AAPL", "XOM"), from = "2004-01-01",

to = "2013-08-01")

print(as.sr(some.rets))

## SR/sqrt(yr) Std. Error t value Pr(>t)

## IBM 0.43 0.32 1.3 0.09045 .

## AAPL 1.05 0.32 3.2 0.00058 ***

## XOM 0.43 0.32 1.3 0.09366 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Unpaired test for Sharpe Ratio

A single equation on multiple signal-noise ratios with independent samples can be computed using the sr_unpaired_test function. This code performs inference via the asymptotic expansion of the Sharpe ratio. The sr_test also acts as a frontend for this code, for the two sample case.

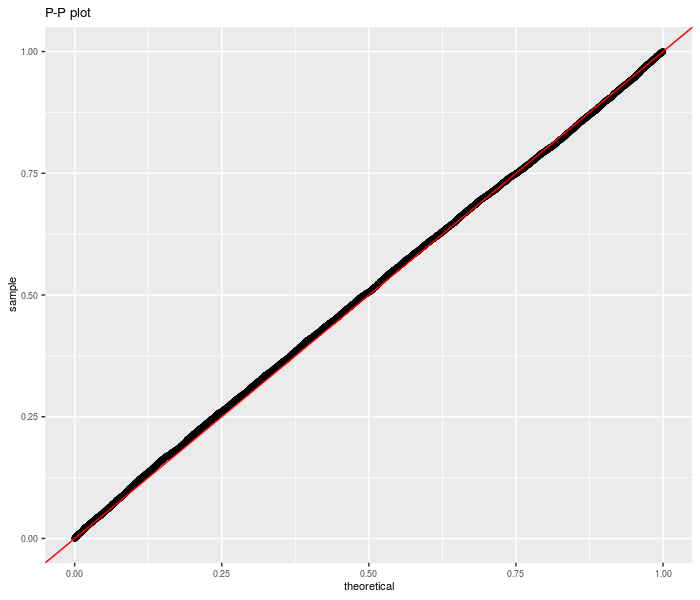

First we perform this test under the null, using randomly generated data. We are testing the sum of three differences of Sharpes here.

set.seed(9001)

pvals <- replicate(10000L, {

X <- matrix(rnorm(500 * 6), ncol = 6)

inp <- as.sr(X)

etc <- sr_unpaired_test(inp)

etc$p.value

})

library(ggplot2)

data <- data.frame(pvals = pvals)

# empirical CDF of the p-values; should be uniform

ph <- ggplot(data, aes(sample = pvals)) + stat_qq(distribution = stats::qunif) +

geom_abline(slope = 1, intercept = 0, colour = "red") +

theme(text = element_text(size = 8)) + labs(title = "P-P plot")

print(ph)

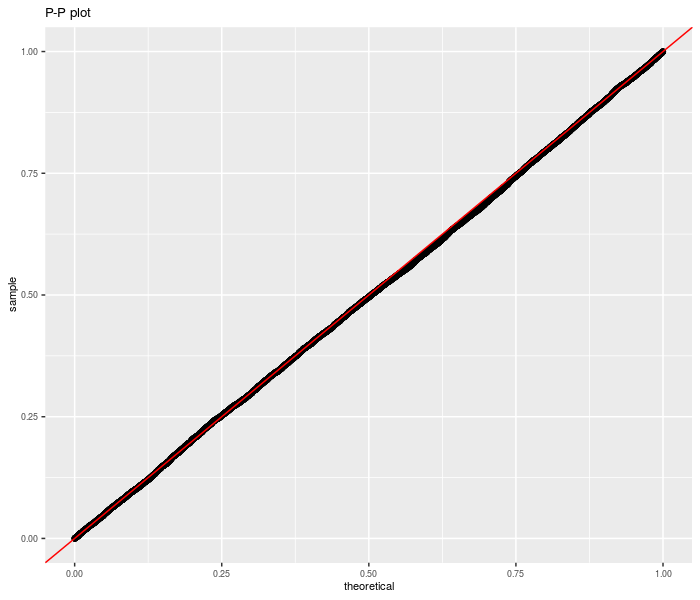

Now we repeat for non-zero null value:

set.seed(9002)

pvals <- replicate(10000L, {

zeta <- 0.1

sg <- 0.01

X <- matrix(rnorm(500 * 6, mean = zeta * sg, sd = sg),

ncol = 6)

inp <- as.sr(X)

etc <- sr_unpaired_test(inp, contrasts = rep(1,

dim(X)[2]), null.value = dim(X)[2] * zeta)

etc$p.value

})

require(ggplot2)

data <- data.frame(pvals = pvals)

# empirical CDF of the p-values; should be uniform

ph <- ggplot(data, aes(sample = pvals)) + stat_qq(distribution = stats::qunif) +

geom_abline(slope = 1, intercept = 0, colour = "red") +

theme(text = element_text(size = 8)) + labs(title = "P-P plot")

print(ph)

Now for real data. We take monthly returns of the three Fama French factors plus momentum (the original Fifth Beatle), then divide into January and non-January periods. We regress Momentum against the other three factors, then convert the linear regression to a Sharpe ratio estimate. The two Sharpe ratios are then thrown into an unpaired sample test. We reject the null of equal idiosyncratic momentum in January versus the rest of the year at the 0.05 level. Is this 'the January Effect'? Perhaps.

library(xts)

if (!require(tsrsa)) {

devtools::install_github("shabbychef/tsrsa")

library(tsrsa)

}

data("mff4", package = "tsrsa")

# January or not

is.jan <- months(index(mff4)) == "January"

# perform linear regression

mod.jan <- lm(UMD ~ Mkt + SMB + HML, data = mff4[is.jan,

])

mod.rem <- lm(UMD ~ Mkt + SMB + HML, data = mff4[!is.jan,

])

# convert lm models to Sharpes

sr.jan <- as.sr(mod.jan)

sr.rem <- as.sr(mod.rem)

# perform unpaired test

etc <- sr_unpaired_test(list(sr.jan, sr.rem), contrasts = c(1,

-1), null.value = 0, ope = 12)

print(etc)

##

## unpaired k-sample sr-test

##

## data: list(sr.jan, sr.rem)

## Wald statistic = -3, df = 90, p-value = 0.004

## alternative hypothesis: true weighted sum of signal-noise ratios is not equal to 0

## 95 percent confidence interval:

## -0.88 0.88

## sample estimates:

## equation on Sharpe ratios

## -1.3

Prediction Intervals

By inflating standard errors, we can compute prediction intervals for future realized Sharpe ratio, with coverage frequency over the full experiment. Here is an example on fake data:

set.seed(9003)

n1 <- 500

n2 <- 100

okvals <- replicate(500, {

zeta <- 0.1

sg <- 0.01

X <- rnorm(n1 + n2, mean = zeta * sg, sd = sg)

inp <- as.sr(X[1:n1])

oos <- as.sr(X[n1 + (1:n2)])

pint <- predint(inp, oosdf = n2 - 1, ope = 1)

is.ok <- (pint[, 1] <= oos$sr) & (oos$sr <= pint[,

2])

is.ok

})

coverage <- mean(okvals)

print(coverage)

## [1] 0.95

For a more complicated example, consider the 'Sharpe' under the attribution model. Here we use the daily data of the three Fama French factors, then perform an attribution of SMB against the market and HML. We compute the factor model Sharpe for the first nine months of each year, and of the last three months separately. Using the first three quarters, we compute a prediction interval for the fourth quarter, then check coverage:

library(xts)

if (!require(tsrsa)) {

devtools::install_github("shabbychef/tsrsa")

library(tsrsa)

}

data("dff4", package = "tsrsa")

dff4 <- dff4["1927-01-01::"]

# shoot me if this is how to get the year number

# from a time index.

yrno <- as.numeric(floor(as.yearmon(index(dff4))))

qname <- quarters(index(dff4))

is.q4 <- (qname == "Q4")

okvals <- lapply(unique(yrno), function(yr) {

isi <- (yrno == yr) & !is.q4

oosi <- (yrno == yr) & is.q4

mod.is <- lm(SMB ~ Mkt + HML, data = dff4[isi,

])

mod.oos <- lm(SMB ~ Mkt + HML, data = dff4[oosi,

])

sr.is <- as.sr(mod.is)

sr.oos <- as.sr(mod.oos)

# compute prediction intervals

pint <- predint(sr.is, oosdf = sr.oos$df, oosrescal = sr.oos$rescal,

ope = sr.oos$ope)

is.ok <- (pint[, 1] <= sr.oos$sr) & (sr.oos$sr <=

pint[, 2])

is.ok

})

coverage <- mean(unlist(okvals))

print(coverage)

## [1] 0.79

It is not clear if non-normality or omitted variable bias (or broken code!) is to blame for the apparent conservatism of the prediction intervals in this case. We can check by simply shuffling the monthly returns data and repeating the experiment:

# shuffle the returns data by row

set.seed(1234)

shufff <- as.data.frame(dff4)

shufff <- shufff[sample.int(nrow(shufff)), ]

okvals <- lapply(unique(yrno), function(yr) {

isi <- (yrno == yr) & !is.q4

oosi <- (yrno == yr) & is.q4

mod.is <- lm(SMB ~ Mkt + HML, data = shufff[isi,

])

mod.oos <- lm(SMB ~ Mkt + HML, data = shufff[oosi,

])

sr.is <- as.sr(mod.is)

sr.oos <- as.sr(mod.oos)

# compute prediction intervals

pint <- predint(sr.is, oosdf = sr.oos$df, oosrescal = sr.oos$rescal,

ope = sr.oos$ope)

is.ok <- (pint[, 1] <= sr.oos$sr) & (sr.oos$sr <=

pint[, 2])

is.ok

})

coverage <- mean(unlist(okvals))

print(coverage)

## [1] 0.94

Of course, this could be a 'lucky seed', but one suspects that non-normality is not the issue, rather there is some autocorrelation of (idiosyncratic) returns (or volatility!).

Inference on the Markowitz Portfolio

The (negative) Markowitz portfolio appears in the inverse of the uncentered second moment matrix of the 'augmented' vector of returns. Via the Central Limit Theorem and the delta method the asymptotic distribution of the Markowitz portfolio can be found. From this, Wald statistics on the individual portfolio weights can be computed. Here I perform this computation on the portfolio consisting of three large cap stocks, and find that the Markowitz weighting of AAPL is significantly non-zero (modulo the selection biases in universe construction). The results are little changed when using a 'robust' covariance estimator.

some.rets <- get.rets(c("IBM", "AAPL", "XOM"), from = "2004-01-01",

to = "2013-08-01")

ism.wald <- function(X, vcov.func = vcov) {

# negating returns is idiomatic to get + Markowitz

ism <- ism_vcov(-as.matrix(X), vcov.func = vcov.func)

ism.mu <- ism$mu[1:ism$p]

ism.Sg <- ism$Ohat[1:ism$p, 1:ism$p]

retval <- ism.mu/sqrt(diag(ism.Sg))

dim(retval) <- c(ism$p, 1)

rownames(retval) <- rownames(ism$mu)[1:ism$p]

return(retval)

}

wald.stats <- ism.wald(some.rets)

print(t(wald.stats))

## IBM AAPL XOM

## [1,] -0.23 2.9 0.17

if (require(sandwich)) {

wald.stats <- ism.wald(some.rets, vcov.func = sandwich::vcovHAC)

print(t(wald.stats))

}

## IBM AAPL XOM

## [1,] -0.22 2.8 0.18