Time Series and Econometric Modeling.

bimets - Time Series And Econometric Modeling In R

bimets is an R package developed with the aim to ease time series analysis and to build up a framework that facilitates the definition, estimation, and simulation of simultaneous equation models.

bimets does not depend on compilers or third-party software so it can be freely downloaded and installed on Linux, MS Windows(R) and Mac OsX(R), without any further requirements.

Please consider reading the package vignette, wherein there are figures and the mathematical expressions are better formatted than in html.

If you have general questions about using bimets, or for bug reports, please use the git issue tracker or write to the maintainer.

Features

TIME SERIES

- supports daily, weekly, monthly, quarterly, semiannual, yearly time series, and frequency of 24 and 36 periods per year.

- indexing by year-period - users can select and modify observations by providing two scalar or two two-dimensional numerical array composed by the year and the period, e.g.

ts[[year,period]]orts[[start]]orts[[start,end]], givenstart<-c(year1,period1)andend<-c(year2,period2)andtsas a time series. - indexing by date - users can select and modify a single observation by using the syntax

ts['Date'], or multiple observations by usingts['StartDate/EndDate']. - indexing by observation index - users can select and modify observations by providing the array of requested indices (core R), e.g.

ts[indices]. - Aggregation/Disaggregation - the package provides advanced (dis)aggregation capabilities, having linear interpolation capabilities in disaggregation, and several aggregation functions (e.g.

STOCK,SUM,AVE, etc.) while reducing the time series frequency. - Manipulation - the package provides, among others, the following time series manipulation capabilities: time series extension

TSEXTEND(), time series mergingTSMERGE(), time series projectionTSPROJECT(), lagTSLAG(), lag differences absolute and percentageTSDELTA()TSDELTAP(), cumulative productCUMPROD(), cumulative sumCUMSUM(), moving averageMOVAVG(), moving sumMOVSUM(), time series data presentationTABIT().

Example:

#create ts

myTS=TIMESERIES((1:100),START=c(2000,1),FREQ='D')

myTS[1:3] #get first three obs.

myTS[[2000,14]] #get year 2000 period 14

myTS[[2032,1]] #get year 2032 period 1 (out of range)

start <- c(2000,20)

end <- c(2000,30)

myTS[[start]] #get year 2000 period 20

myTS[[start,end]] #get from year-period 2000-20 to 2000-30

myTS['2000-01-12'] #get Jan 12, 2000

myTS['2000-02-03/2000-03-04'] #get Feb 3 up to Mar 4

myTS[[2000,3]] <- pi #assign to Jan 3, 2000

myTS[[2000,42]] <- NA #assign to Feb 11, 2000

myTS[[2000,100]] <- c(-1,-2,-3) #assign array starting from period 100 (i.e. extend series)

myTS[[start]] <- NA #assign to year-period 2000-20

myTS[[start,end]] <- 3.14 #assign from year-period 2000-20 to 2000-30

myTS[[start,end]] <- -(1:11) #assign multiple values

#from year-period 2000-20 to 2000-30

myTS['2000-01-15'] <- 42 #assign to Jan 15, 2000

#aggregation/disaggregation

myMonthlyTS <- TIMESERIES(1:100,START=c(2000,1),FREQ='M')

myYearlyTS <- YEARLY(myMonthlyTS,'AVE')

myDailyTS <- DAILY(myMonthlyTS,'INTERP_CENTER')

#create and manipulate time series

myTS1 <- TIMESERIES(1:100,START=c(2000,1),FREQ='M')

myTS2 <- TIMESERIES(-(1:100),START=c(2005,1),FREQ='M')

#extend time series

myExtendedTS <- TSEXTEND(myTS1,UPTO = c(2020,4),EXTMODE = 'QUADRATIC')

#merge two time series

myMergedTS <-TSMERGE(myExtendedTS,myTS2,fun = 'SUM')

#project time series

myProjectedTS <- TSPROJECT(myMergedTS,TSRANGE = c(2004,2,2006,4))

#lag time series

myLagTS <- TSLAG(myProjectedTS,2)

#percentage delta of time series

myDeltaPTS <- TSDELTAP(myLagTS,2)

#moving average of time series

myMovAveTS <- MOVAVG(myDeltaPTS,5)

#print data

TABIT(myMovAveTS,myTS1)

# Date, Prd., myMovAveTS , myTS1

#

# Jan 2000, 1 , , 1

# Feb 2000, 2 , , 2

# Mar 2000, 3 , , 3

# ...

# Sep 2004, 9 , , 57

# Oct 2004, 10 , 3.849002 , 58

# Nov 2004, 11 , 3.776275 , 59

# Dec 2004, 12 , 3.706247 , 60

# Jan 2005, 1 , 3.638771 , 61

# Feb 2005, 2 , 3.573709 , 62

# Mar 2005, 3 , 3.171951 , 63

# Apr 2005, 4 , 2.444678 , 64

# May 2005, 5 , 1.730393 , 65

# Jun 2005, 6 , 1.028638 , 66

# Jul 2005, 7 , 0.3389831 , 67

# Aug 2005, 8 , 0 , 68

# Sep 2005, 9 , 0 , 69

# Oct 2005, 10 , 0 , 70

# ...

# Mar 2008, 3 , , 99

# Apr 2008, 4 , , 100

More details are available in the reference manual.

MODELING:

bimets econometric modeling capabilities comprehend:

- Model Description Language - the specification of an econometric model is translated and identified by keyword statements which are grouped in a model file, i.e. a plain text file or a

characterR variable with a specific syntax. Collectively, these keyword statements constitute a kind of a bimets Model Description Language (i.e.MDL). The MDL syntax allows the definition of behavioral equations, technical equations, conditional evaluations during the simulation, and other model properties. - Estimation - the estimation function

ESTIMATE()supports Ordinary Least Squares, Instrumental Variables, deterministic linear restrictions on the coefficients, Almon Polynomial Distributed Lags (i.e.PDL), autocorrelation of the errors, structural stability analysis (Chow tests). - Simulation - the simulation function

SIMULATE()supports static, dynamic and forecast simulations, residuals check, partial or total exogenization of endogenous variables, constant adjustment of endogenous variables (i.e. add-factors). - Rational Expectations - bimets supports forward-looking models, i.e. models having a

TSLEADfunction in theirs equations applied to an endogenous variable; Forward-looking models assume that economic agents have complete knowledge of an economic system and calculate the future value of economic variables correctly according to that knowledge. Thus, forward-looking models are called also rational expectations models and, in macro-econometric models, model-consistent expectations. - Stochastic Simulation - in the stochastic simulation function

STOCHSIMULATE()the structural disturbances are given values that have specified stochastic properties. The error terms of the estimated behavioral equation of the model are appropriately perturbed. Identity equations and exogenous variables can be as well perturbed by disturbances that have specified stochastic properties. The model is then solved for each data set with different values of the disturbances. Finally, mean and standard deviation are computed for each simulated endogenous variable. - Multipliers Evaluation - the multipliers evaluation function

MULTMATRIX()computes the matrix of both impact and interim multipliers for a selected set of endogenous variables, i.e. theTARGET, with respect to a selected set of exogenous variables, i.e. theINSTRUMENT. - Endogenous Targeting - the "renormalization" function

RENORM()performs the endogenous targeting of econometric models, which consists of solving the model while interchanging the role of one or more endogenous variables with an equal number of exogenous variables. The procedure determines the values for theINSTRUMENTexogenous variables that allow achieving the desired values for theTARGETendogenous variables, subject to the constraints given by the equations of the model. This is an approach to economic and monetary policy analysis. - Optimal Control - The optimization consists of maximizing a social welfare function, i.e. the objective-function, depending on exogenous and (simulated) endogenous variables, subject to user constraints plus the constraints imposed by the econometric model equations. Users are allowed to define constraints and objective-functions of any degree, and are allowed to provide different constraints and objective-functions in different optimization time periods.

A Klein's model example, having restrictions, error autocorrelation, and conditional evaluations, follows. For more realistic scenarios, several advanced econometric exercises on the US Federal Reserve FRB/US econometric model (e.g., dynamic simulation in a monetary policy shock, rational expectations, endogenous targeting, stochastic simulation, etc.) are available in the "US Federal Reserve quarterly model (FRB/US) in R with bimets" vignette:

# MODEL DEFINITION AND LOADING #################################################

#define the Klein model

klein1.txt <- "MODEL

COMMENT> Modified Klein Model 1 of the U.S. Economy with PDL,

COMMENT> autocorrelation on errors, restrictions, and conditional equation evaluations

COMMENT> Consumption with autocorrelation on errors

BEHAVIORAL> cn

TSRANGE 1923 1 1940 1

EQ> cn = a1 + a2*p + a3*TSLAG(p,1) + a4*(w1+w2)

COEFF> a1 a2 a3 a4

ERROR> AUTO(2)

COMMENT> Investment with restrictions

BEHAVIORAL> i

TSRANGE 1923 1 1940 1

EQ> i = b1 + b2*p + b3*TSLAG(p,1) + b4*TSLAG(k,1)

COEFF> b1 b2 b3 b4

RESTRICT> b2 + b3 = 1

COMMENT> Demand for Labor with PDL

BEHAVIORAL> w1

TSRANGE 1923 1 1940 1

EQ> w1 = c1 + c2*(y+t-w2) + c3*TSLAG(y+t-w2,1) + c4*time

COEFF> c1 c2 c3 c4

PDL> c3 1 2

COMMENT> Gross National Product

IDENTITY> y

EQ> y = cn + i + g - t

COMMENT> Profits

IDENTITY> p

EQ> p = y - (w1+w2)

COMMENT> Capital Stock with IF switches

IDENTITY> k

EQ> k = TSLAG(k,1) + i

IF> i > 0

IDENTITY> k

EQ> k = TSLAG(k,1)

IF> i <= 0

END"

#load the model

kleinModel <- LOAD_MODEL(modelText = klein1.txt)

# Loading model: "klein1.txt"...

# Analyzing behaviorals...

# Analyzing identities...

# Optimizing...

# Loaded model "klein1.txt":

# 3 behaviorals

# 3 identities

# 12 coefficients

# ...LOAD MODEL OK

kleinModel$behaviorals$cn

# $eq

# [1] "cn=a1+a2*p+a3*TSLAG(p,1)+a4*(w1+w2)"

#

# $eqCoefficientsNames

# [1] "a1" "a2" "a3" "a4"

#

# $eqComponentsNames

# [1] "cn" "p" "w1" "w2"

#

# $tsrange

# [1] 1925 1 1941 1

#

# $eqRegressorsNames

# [1] "1" "p" "TSLAG(p,1)" "(w1+w2)"

#

# $eqSimExp

# expression(cn[2,]=cn__ADDFACTOR[2,]+cn__a1+cn__a2*p[2,]+cn__a3*...

#

# ...and more

kleinModel$incidence_matrix

# cn i w1 y p k

# cn 0 0 1 0 1 0

# i 0 0 0 0 1 0

# w1 0 0 0 1 0 0

# y 1 1 0 0 0 0

# p 0 0 1 1 0 0

# k 0 1 0 0 0 0

#define data

kleinModelData <- list(

cn =TIMESERIES(39.8,41.9,45,49.2,50.6,52.6,55.1,56.2,57.3,57.8,

55,50.9,45.6,46.5,48.7,51.3,57.7,58.7,57.5,61.6,65,69.7,

START=c(1920,1),FREQ=1),

g =TIMESERIES(4.6,6.6,6.1,5.7,6.6,6.5,6.6,7.6,7.9,8.1,9.4,10.7,

10.2,9.3,10,10.5,10.3,11,13,14.4,15.4,22.3,

START=c(1920,1),FREQ=1),

i =TIMESERIES(2.7,-.2,1.9,5.2,3,5.1,5.6,4.2,3,5.1,1,-3.4,-6.2,

-5.1,-3,-1.3,2.1,2,-1.9,1.3,3.3,4.9,

START=c(1920,1),FREQ=1),

k =TIMESERIES(182.8,182.6,184.5,189.7,192.7,197.8,203.4,207.6,

210.6,215.7,216.7,213.3,207.1,202,199,197.7,199.8,

201.8,199.9,201.2,204.5,209.4,

START=c(1920,1),FREQ=1),

p =TIMESERIES(12.7,12.4,16.9,18.4,19.4,20.1,19.6,19.8,21.1,21.7,

15.6,11.4,7,11.2,12.3,14,17.6,17.3,15.3,19,21.1,23.5,

START=c(1920,1),FREQ=1),

w1 =TIMESERIES(28.8,25.5,29.3,34.1,33.9,35.4,37.4,37.9,39.2,41.3,

37.9,34.5,29,28.5,30.6,33.2,36.8,41,38.2,41.6,45,53.3,

START=c(1920,1),FREQ=1),

y =TIMESERIES(43.7,40.6,49.1,55.4,56.4,58.7,60.3,61.3,64,67,57.7,

50.7,41.3,45.3,48.9,53.3,61.8,65,61.2,68.4,74.1,85.3,

START=c(1920,1),FREQ=1),

t =TIMESERIES(3.4,7.7,3.9,4.7,3.8,5.5,7,6.7,4.2,4,7.7,7.5,8.3,5.4,

6.8,7.2,8.3,6.7,7.4,8.9,9.6,11.6,

START=c(1920,1),FREQ=1),

time=TIMESERIES(NA,-10,-9,-8,-7,-6,-5,-4,-3,-2,-1,0,

1,2,3,4,5,6,7,8,9,10,

START=c(1920,1),FREQ=1),

w2 =TIMESERIES(2.2,2.7,2.9,2.9,3.1,3.2,3.3,3.6,3.7,4,4.2,4.8,

5.3,5.6,6,6.1,7.4,6.7,7.7,7.8,8,8.5,

START=c(1920,1),FREQ=1)

);

kleinModel <- LOAD_MODEL_DATA(kleinModel,kleinModelData)

# Load model data "kleinModelData" into model "klein1.txt"...

# ...LOAD MODEL DATA OK

# MODEL ESTIMATION #############################################################

kleinModel <- ESTIMATE(kleinModel)

#.CHECK_MODEL_DATA(): warning, there are undefined values in time series "time".

#

#Estimate the Model klein1.txt:

#the number of behavioral equations to be estimated is 3.

#The total number of coefficients is 13.

#

#_________________________________________

#

#BEHAVIORAL EQUATION: cn

#Estimation Technique: OLS

#Autoregression of Order 2 (Cochrane-Orcutt procedure)

#

#Convergence was reached in 6 / 20 iterations.

#

#

#cn = 14.82685

# T-stat. 7.608453 ***

#

# + 0.2589094 p

# T-stat. 2.959808 *

#

# + 0.01423821 TSLAG(p,1)

# T-stat. 0.1735191

#

# + 0.8390274 (w1+w2)

# T-stat. 14.67959 ***

#

#ERROR STRUCTURE: AUTO(2)

#

#AUTOREGRESSIVE PARAMETERS:

#Rho Std. Error T-stat.

# 0.2542111 0.2589487 0.9817045

#-0.05250591 0.2593578 -0.2024458

#

#

#STATs:

#R-Squared : 0.9826778

#Adjusted R-Squared : 0.9754602

#Durbin-Watson Statistic : 2.256004

#Sum of squares of residuals : 8.071633

#Standard Error of Regression : 0.8201439

#Log of the Likelihood Function : -18.32275

#F-statistic : 136.1502

#F-probability : 3.873514e-10

#Akaike's IC : 50.6455

#Schwarz's IC : 56.8781

#Mean of Dependent Variable : 54.29444

#Number of Observations : 18

#Number of Degrees of Freedom : 12

#Current Sample (year-period) : 1923-1 / 1940-1

#

#

#Signif. codes: *** 0.001 ** 0.01 * 0.05

#

#

# ...similar output for all the regressions.

# MODEL SIMULATION #############################################################

#simulate GNP in 1925-1930

kleinModel <- SIMULATE(kleinModel,

TSRANGE=c(1925,1,1930,1),

simIterLimit = 100)

# Simulation: 100.00%

# ...SIMULATE OK

#print simulated GNP

TABIT(kleinModel$simulation$y)

#

# Date, Prd., kleinModel$simulation$y

#

# 1925, 1 , 58.24584

# 1926, 1 , 44.56501

# 1927, 1 , 28.2727

# 1928, 1 , 27.10598

# 1929, 1 , 37.57604

# 1930, 1 , 37.44899

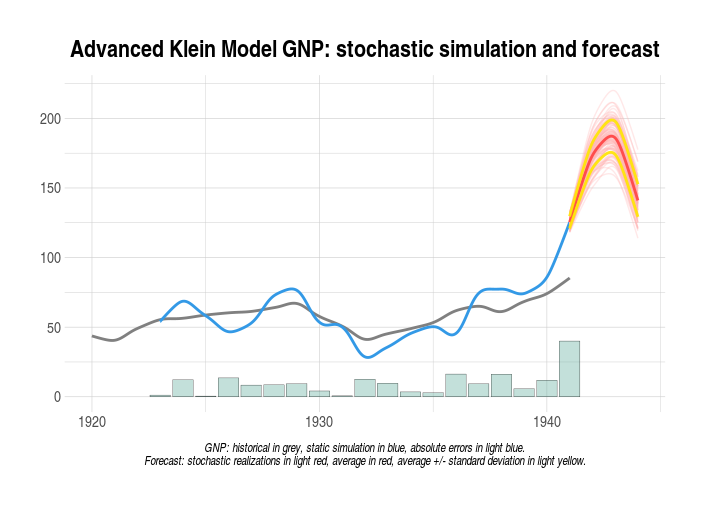

# MODEL STOCHASTIC FORECAST ####################################################

#we want to perform a stochastic forecast of the GNP up to 1944

#we will add normal disturbances to endogenous Consumption 'cn'

#in 1942 by using its regression standard error

#we will add uniform disturbances to exogenous Government Expenditure 'g'

#in whole TSRANGE

myStochStructure <- list(

cn=list(

TSRANGE=c(1942,1,1942,1),

TYPE='NORM',

PARS=c(0,kleinModel$behaviorals$cn$statistics$StandardErrorRegression)

),

g=list(

TSRANGE=TRUE,

TYPE='UNIF',

PARS=c(-1,1)

)

)

#we need to extend exogenous variables up to 1944

kleinModel$modelData <- within(kleinModel$modelData,{

w2 = TSEXTEND(w2, UPTO=c(1944,1),EXTMODE='CONSTANT')

t = TSEXTEND(t, UPTO=c(1944,1),EXTMODE='LINEAR')

g = TSEXTEND(g, UPTO=c(1944,1),EXTMODE='CONSTANT')

k = TSEXTEND(k, UPTO=c(1944,1),EXTMODE='LINEAR')

time = TSEXTEND(time,UPTO=c(1944,1),EXTMODE='LINEAR')

})

#stochastic model forecast

kleinModel <- STOCHSIMULATE(kleinModel

,simType='FORECAST'

,TSRANGE=c(1941,1,1944,1)

,StochStructure=myStochStructure

,StochSeed=123

)

#print mean and standard deviation of forecasted GNP

with(kleinModel$stochastic_simulation,TABIT(y$mean, y$sd))

# Date, Prd., y$mean , y$sd

#

# 1941, 1 , 125.5045 , 4.250935

# 1942, 1 , 173.2946 , 9.2632

# 1943, 1 , 185.9602 , 11.87774

# 1944, 1 , 141.0807 , 11.6973

# MODEL MULTIPLIERS ###########################################################

#get multiplier matrix in 1941

kleinModel <- MULTMATRIX(kleinModel,

TSRANGE=c(1941,1,1941,1),

INSTRUMENT=c('w2','g'),

TARGET=c('cn','y'),

simIterLimit = 100)

# Multiplier Matrix: 100.00%

# ...MULTMATRIX OK

kleinModel$MultiplierMatrix

# w2_1 g_1

#cn_1 0.2338194 3.753277

#y_1 -0.2002040 7.444930

# MODEL ENDOGENOUS TARGETING ###################################################

#we want an arbitrary value on Consumption of 66 in 1940 and 78 in 1941

#we want an arbitrary value on GNP of 77 in 1940 and 98 in 1941

kleinTargets <- list(

cn = TIMESERIES(66,78,START=c(1940,1),FREQ=1),

y = TIMESERIES(77,98,START=c(1940,1),FREQ=1)

)

#Then, we can perform the model endogenous targeting

#by using Government Wage Bill 'w2'

#and Government Expenditure 'g' as

#INSTRUMENT in the years 1940 and 1941:

kleinModel <- RENORM(kleinModel

,simConvergence=1e-5

,INSTRUMENT = c('w2','g')

,TARGET = kleinTargets

,TSRANGE = c(1940,1,1941,1)

,simIterLimit = 100

)

# Convergence reached in 3 iterations.

# ...RENORM OK

#The calculated values of exogenous INSTRUMENT

#that allow achieving the desired endogenous TARGET values

#are stored into the model:

with(kleinModel,TABIT(modelData$w2,

renorm$INSTRUMENT$w2,

modelData$g,

renorm$INSTRUMENT$g))

# Date, Prd., modelData$w2, renorm$w2, modelData$g, renorm$g

#

# ...

#

# 1938, 1 , 7.7 , , 13 ,

# 1939, 1 , 7.8 , , 14.4 ,

# 1940, 1 , 8 , 5.577777 , 15.4 , 14.14058

# 1941, 1 , 8.5 , 5.354341 , 22.3 , 17.80586

#So, if we want to achieve on "cn" (Consumption) an arbitrary simulated value of 66 in 1940

#and 78 in 1941, and if we want to achieve on "y" (GNP) an arbitrary simulated value of 77

#in 1940 and 98 in 1941, we need to change exogenous "w2" (Wage Bill of the Government

#Sector) from 8 to 5.58 in 1940 and from 8.5 to 5.35 in 1941, and we need to change exogenous

#"g"(Government Expenditure) from 15.4 to 14.14 in 1940 and from 22.3 to 17.81 in 1941.

#Let's verify:

#create a new model

kleinRenorm <- kleinModel

#update the required INSTRUMENT

kleinRenorm$modelData <- kleinRenorm$renorm$modelData

#simulate the new model

kleinRenorm <- SIMULATE(kleinRenorm

,TSRANGE=c(1940,1,1941,1)

,simConvergence=1e-4

,simIterLimit=100

)

#Simulation: 100.00%

#...SIMULATE OK

#verify TARGETs are achieved

with(kleinRenorm$simulation,

TABIT(cn,y)

)

# Date, Prd., cn , y

#

# 1940, 1 , 65.99977 , 76.9996

# 1941, 1 , 77.99931 , 97.99879

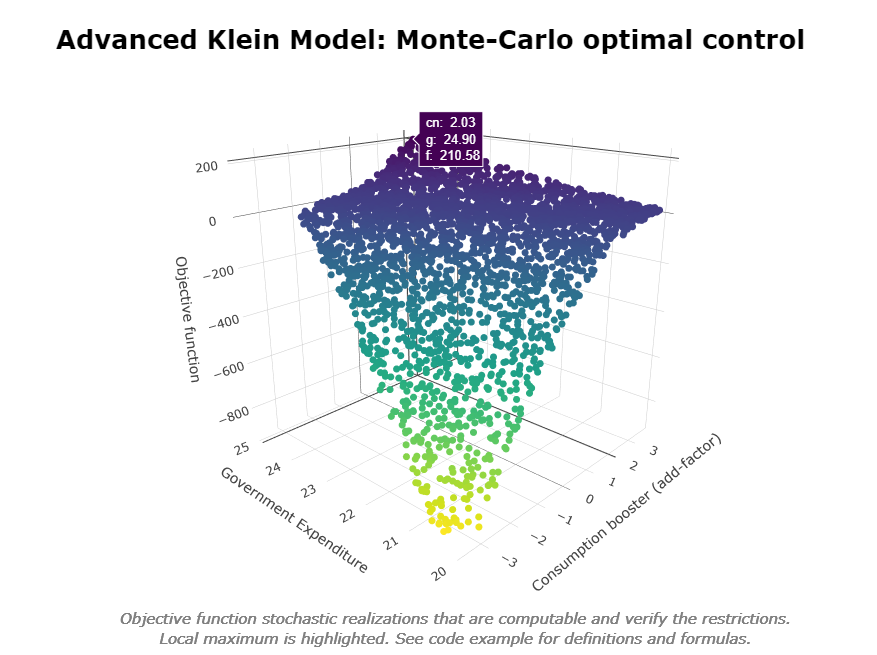

# MODEL OPTIMAL CONTROL ########################################################

#reset time series data in model

kleinModel <- LOAD_MODEL_DATA(kleinModel

,kleinModelData

,quietly = TRUE)

#we want to maximize the non-linear objective function:

#f()=(y-110)+(cn-90)*ABS(cn-90)-(g-20)^0.5

#in 1942 by using INSTRUMENT cn in range (-5,5)

#(cn is endogenous so we use the add-factor)

#and g in range (15,25)

#we will also impose the following non-linear restriction:

#g+(cn^2)/2<27 & g+cn>17

#we need to extend exogenous variables up to 1942

kleinModel$modelData <- within(kleinModel$modelData,{

w2 = TSEXTEND(w2, UPTO = c(1942,1), EXTMODE = 'CONSTANT')

t = TSEXTEND(t, UPTO = c(1942,1), EXTMODE = 'LINEAR')

g = TSEXTEND(g, UPTO = c(1942,1), EXTMODE = 'CONSTANT')

k = TSEXTEND(k, UPTO = c(1942,1), EXTMODE = 'LINEAR')

time = TSEXTEND(time, UPTO = c(1942,1), EXTMODE = 'LINEAR')

})

#define INSTRUMENT and boundaries

myOptimizeBounds <- list(

cn = list( TSRANGE = TRUE

,BOUNDS = c(-5,5)),

g = list( TSRANGE = TRUE

,BOUNDS = c(15,25))

)

#define restrictions

myOptimizeRestrictions <- list(

myRes1=list(

TSRANGE = TRUE

,INEQUALITY = 'g+(cn^2)/2<27 & g+cn>17')

)

#define objective function

myOptimizeFunctions <- list(

myFun1 = list(

TSRANGE = TRUE

,FUNCTION = '(y-110)+(cn-90)*ABS(cn-90)-(g-20)^0.5')

)

#Monte-Carlo optimization by using 10.000 stochastic realizations

#and 1E-7 convergence criterion

kleinModel <- OPTIMIZE(kleinModel

,simType = 'FORECAST'

,TSRANGE=c(1942,1,1942,1)

,simConvergence= 1E-7

,simIterLimit = 100

,StochReplica = 10000

,StochSeed = 123

,OptimizeBounds = myOptimizeBounds

,OptimizeRestrictions = myOptimizeRestrictions

,OptimizeFunctions = myOptimizeFunctions

,quietly = TRUE)

#print local maximum

kleinModel$optimize$optFunMax

#[1] 210.577

#print INSTRUMENT that allow local maximum to be achieved

kleinModel$optimize$INSTRUMENT

#$cn

#Time Series:

#Start = 1942

#End = 1942

#Frequency = 1

#[1] 2.032203

#

#$g

#Time Series:

#Start = 1942

#End = 1942

#Frequency = 1

#[1] 24.89773

# RATIONAL EXPECTATIONS ########################################################

# EXAMPLE OF FORWARD-LOOKING KLEIN-LIKE MODEL

# HAVING RATIONAL EXPECTATION ON INVESTMENTS

#define model

kleinLeadModelDefinition<-

"MODEL

COMMENT> Klein Model 1 of the U.S. Economy

COMMENT> Consumption

BEHAVIORAL> cn

TSRANGE 1921 1 1941 1

EQ> cn = a1 + a2*p + a3*TSLAG(p,1) + a4*(w1+w2)

COEFF> a1 a2 a3 a4

COMMENT> Investment with TSLEAD

IDENTITY> i

EQ> i = (MOVAVG(i,2)+TSLEAD(i))/2

COMMENT> Demand for Labor

BEHAVIORAL> w1

TSRANGE 1921 1 1941 1

EQ> w1 = c1 + c2*(y+t-w2) + c3*TSLAG(y+t-w2,1) + c4*time

COEFF> c1 c2 c3 c4

COMMENT> Gross National Product

IDENTITY> y

EQ> y = cn + i + g - t

COMMENT> Profits

IDENTITY> p

EQ> p = y - (w1+w2)

COMMENT> Capital Stock

IDENTITY> k

EQ> k = TSLAG(k,1) + i

END"

#define model data

kleinLeadModelData<-list(

cn

=TIMESERIES(39.8,41.9,45,49.2,50.6,52.6,55.1,56.2,57.3,57.8,55,50.9,

45.6,46.5,48.7,51.3,57.7,58.7,57.5,61.6,65,69.7,

START=c(1920,1),FREQ=1),

g

=TIMESERIES(4.6,6.6,6.1,5.7,6.6,6.5,6.6,7.6,7.9,8.1,9.4,10.7,10.2,9.3,10,

10.5,10.3,11,13,14.4,15.4,22.3,

START=c(1920,1),FREQ=1),

i

=TIMESERIES(2.7,-.2,1.9,5.2,3,5.1,5.6,4.2,3,5.1,1,-3.4,-6.2,-5.1,-3,-1.3,

2.1,2,-1.9,1.3,3.3,4.9,

START=c(1920,1),FREQ=1),

k

=TIMESERIES(182.8,182.6,184.5,189.7,192.7,197.8,203.4,207.6,210.6,215.7,

216.7,213.3,207.1,202,199,197.7,199.8,201.8,199.9,

201.2,204.5,209.4,

START=c(1920,1),FREQ=1),

p

=TIMESERIES(12.7,12.4,16.9,18.4,19.4,20.1,19.6,19.8,21.1,21.7,15.6,11.4,

7,11.2,12.3,14,17.6,17.3,15.3,19,21.1,23.5,

START=c(1920,1),FREQ=1),

w1

=TIMESERIES(28.8,25.5,29.3,34.1,33.9,35.4,37.4,37.9,39.2,41.3,37.9,34.5,

29,28.5,30.6,33.2,36.8,41,38.2,41.6,45,53.3,

START=c(1920,1),FREQ=1),

y

=TIMESERIES(43.7,40.6,49.1,55.4,56.4,58.7,60.3,61.3,64,67,57.7,50.7,41.3,

45.3,48.9,53.3,61.8,65,61.2,68.4,74.1,85.3,

START=c(1920,1),FREQ=1),

t

=TIMESERIES(3.4,7.7,3.9,4.7,3.8,5.5,7,6.7,4.2,4,7.7,7.5,8.3,5.4,6.8,7.2,

8.3,6.7,7.4,8.9,9.6,11.6,

START=c(1920,1),FREQ=1),

time

=TIMESERIES(NA,-10,-9,-8,-7,-6,-5,-4,-3,-2,-1,0,1,2,3,4,5,6,7,8,9,10,

START=c(1920,1),FREQ=1),

w2

=TIMESERIES(2.2,2.7,2.9,2.9,3.1,3.2,3.3,3.6,3.7,4,4.2,4.8,5.3,5.6,6,6.1,

7.4,6.7,7.7,7.8,8,8.5,

START=c(1920,1),FREQ=1)

)

#load model and model data

kleinLeadModel<-LOAD_MODEL(modelText=kleinLeadModelDefinition)

kleinLeadModel<-LOAD_MODEL_DATA(kleinLeadModel,kleinLeadModelData)

#estimate model

kleinLeadModel<-ESTIMATE(kleinLeadModel, quietly = TRUE)

#set expected value of 2 for Investment in 1931

#(note that simulation TSRANGE spans up to 1930)

kleinLeadModel$modelData$i[[1931,1]]<-2

#simulate model

kleinLeadModel<-SIMULATE(kleinLeadModel

,TSRANGE=c(1924,1,1930,1))

#print simulated investments

TABIT(kleinLeadModel$simulation$i)

#Date, Prd., kleinLeadModel$simulation$i

#

# 1924, 1 , 3.594946

# 1925, 1 , 2.792062

# 1926, 1 , 2.390277

# 1927, 1 , 2.189125

# 1928, 1 , 2.08838

# 1929, 1 , 2.037915

# 1930, 1 , 2.012644

MODEL DESCRIPTION LANGUAGE SYNTAX

The mathematical expression available for use in model equations can include the standard arithmetic operators, parentheses and the following MDL functions:

TSLAG(ts,i): lag the ts time series by i-periods;TSLEAD(ts,i): lead the ts time series by i-periods;TSDELTA(ts,i): i-periods difference of the ts time series;TSDELTAP(ts,i): i-periods percentage difference of the ts time series;TSDELTALOG(ts,i): i-periods logarithmic difference of the ts time series;MOVAVG(ts,i): i-periods moving average of the ts time series;MOVSUM(ts,i): i-periods moving sum of the ts time series;LOG(ts): log of the ts time series;EXP(ts): exponential of the ts time series;ABS(ts): absolute values of the ts time series.

Transformations of the dependent variable are allowed in EQ> definition, e.g. TSDELTA(cn)=..., EXP(i)=..., TSDELTALOG(y)=..., etc.

More details are available in the reference manual.

COMPUTATIONAL DETAILS

The iterative simulation procedure is the most time-consuming operation of the bimets package. For small models, this operation is quite immediate; on the other hand, the simulation of models that count hundreds of equations could last for minutes, especially if the requested operation involves a parallel simulation having hundreds of realizations per equation. This could be the case for the endogenous targeting, the stochastic simulation and the optimal control. In these cases, a Newton-Raphson algorithm can speed up the execution.

The SIMULATE code has been optimized in order to minimize the execution time in these cases. In terms of computational efficiency, the procedure takes advantage of the fact that multiple datasets are bound together in matrices, therefore in order to achieve a global convergence, the iterative simulation algorithm is executed once for all perturbed datasets. This solution can be viewed as a sort of a SIMD (i.e. Single Instruction Multiple Data) parallel simulation: the SIMULATE algorithm transforms time series into matrices and consequently can easily bind multiple datasets by column. At the same time, the single run ensures a fast code execution, while each column in the output matrices represents a stochastic or perturbed realization.

The above approach is even faster if R has been compiled and linked to optimized multi-threaded numerical libraries, e.g. Intel(R) MKL, OpenBlas, Microsoft(R) R Open, etc.

Finally, model equations are pre-fetched into sorted R expressions, and an optimized R environment is defined and reserved to the SIMULATE algorithm; this approach removes the overhead usually caused by expression parsing and by the R looking for variables inside nested environments.

bimets estimation and simulation results have been compared to the output results of leading commercial econometric software by using several large and complex models.

The models used in the comparison have more than:

- +100 behavioral equations;

- +700 technical identities;

- +500 coefficients;

- +1000 time series of endogenous and exogenous variables;

In these models, we can find equations with restricted coefficients, polynomial distributed lags, error autocorrelation, and conditional evaluation of technical identities; all models have been simulated in static, dynamic, and forecast mode, with exogenization and constant adjustments of endogenous variables, through the use of bimets capabilities.

In the +800 endogenous simulated time series over the +20 simulated periods (i.e. more than 16.000 simulated observations), the average percentage difference between bimets and leading commercial software results has a magnitude of 10E-7 %. The difference between results calculated by using different commercial software has the same average magnitude.

Several advanced econometric exercises on the US Federal Reserve FRB/US econometric model (e.g., dynamic simulation in a monetary policy shock, rational expectations, endogenous targeting, stochastic simulation, etc.) are available in the "US Federal Reserve quarterly model (FRB/US) in R with bimets" vignette.

Installation

The package can be installed and loaded in R with the following commands:

install.packages("bimets")

library(bimets)

Guidelines for contributing

We welcome contributions to the bimets package. In the case, please use the git issue tracker or write to the maintainer.

License

The bimets package is licensed under the GPL-3.

Disclaimer: The views and opinions expressed in these pages are those of the authors and do not necessarily reflect the official policy or position of the Bank of Italy. Examples of analysis performed within these pages are only examples. They should not be utilized in real-world analytic products as they are based only on very limited and dated open source information. Assumptions made within the analysis are not reflective of the position of the Bank of Italy.