Bayesian Vector Heterogeneous Autoregressive Modeling.

bvhar

Overview

bvhar provides functions to analyze multivariate time series time series using

- VAR

- VHAR (Vector HAR)

- BVAR (Bayesian VAR)

- BVHAR (Bayesian VHAR)

Basically, the package focuses on the research with forecasting.

Installation

install.packages("bvhar")

Development version

You can install the development version from develop branch.

# install.packages("remotes")

remotes::install_github("ygeunkim/bvhar@develop")

Models

library(bvhar) # this package

library(dplyr)

Repeatedly, bvhar is a research tool to analyze multivariate time series model above

| Model | function | prior |

|---|---|---|

| VAR | var_lm() | |

| VHAR | vhar_lm() | |

| BVAR | bvar_minnesota() | Minnesota |

| BVHAR | bvhar_minnesota() | Minnesota |

| BVAR-SV | bvar_sv() | SSVS, Horseshoe |

| BVHAR-SV | bvhar_sv() | SSVS, Horseshoe |

This readme document shows forecasting procedure briefly. Details about each function are in vignettes and help documents.

h-step ahead forecasting:

h <- 19

etf_split <- divide_ts(etf_vix, h) # Try ?divide_ts

etf_tr <- etf_split$train

etf_te <- etf_split$test

VAR

VAR(5):

mod_var <- var_lm(y = etf_tr, p = 5)

Forecasting:

forecast_var <- predict(mod_var, h)

MSE:

(msevar <- mse(forecast_var, etf_te))

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 5.381 14.689 2.838 9.451 10.078 0.654 22.436 9.992

#> VXEWZCLS

#> 10.647

VHAR

mod_vhar <- vhar_lm(y = etf_tr)

MSE:

forecast_vhar <- predict(mod_vhar, h)

(msevhar <- mse(forecast_vhar, etf_te))

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 6.15 2.49 1.52 1.58 10.55 1.35 8.79 4.43

#> VXEWZCLS

#> 3.84

BVAR

Minnesota prior:

lam <- .3

delta <- rep(1, ncol(etf_vix)) # litterman

sig <- apply(etf_tr, 2, sd)

eps <- 1e-04

(bvar_spec <- set_bvar(sig, lam, delta, eps))

#> Model Specification for BVAR

#>

#> Parameters: Coefficent matrice and Covariance matrix

#> Prior: Minnesota

#> # Type '?bvar_minnesota' in the console for some help.

#> ========================================================

#>

#> Setting for 'sigma':

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 3.77 10.63 3.81 4.39 5.99 2.27 4.88 7.45

#> VXEWZCLS

#> 7.03

#>

#> Setting for 'lambda':

#> [1] 0.3

#>

#> Setting for 'delta':

#> [1] 1 1 1 1 1 1 1 1 1

#>

#> Setting for 'eps':

#> [1] 1e-04

mod_bvar <- bvar_minnesota(y = etf_tr, p = 5, bayes_spec = bvar_spec)

MSE:

forecast_bvar <- predict(mod_bvar, h)

(msebvar <- mse(forecast_bvar, etf_te))

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 4.463 13.510 1.336 11.267 9.802 0.862 21.929 5.418

#> VXEWZCLS

#> 7.362

BVHAR

BVHAR-S:

(bvhar_spec_v1 <- set_bvhar(sig, lam, delta, eps))

#> Model Specification for BVHAR

#>

#> Parameters: Coefficent matrice and Covariance matrix

#> Prior: MN_VAR

#> # Type '?bvhar_minnesota' in the console for some help.

#> ========================================================

#>

#> Setting for 'sigma':

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 3.77 10.63 3.81 4.39 5.99 2.27 4.88 7.45

#> VXEWZCLS

#> 7.03

#>

#> Setting for 'lambda':

#> [1] 0.3

#>

#> Setting for 'delta':

#> [1] 1 1 1 1 1 1 1 1 1

#>

#> Setting for 'eps':

#> [1] 1e-04

mod_bvhar_v1 <- bvhar_minnesota(y = etf_tr, bayes_spec = bvhar_spec_v1)

MSE:

forecast_bvhar_v1 <- predict(mod_bvhar_v1, h)

(msebvhar_v1 <- mse(forecast_bvhar_v1, etf_te))

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 3.58 4.76 1.32 5.71 6.29 1.15 14.03 2.52

#> VXEWZCLS

#> 5.41

BVHAR-L:

day <- rep(.1, ncol(etf_vix))

week <- rep(.1, ncol(etf_vix))

month <- rep(.1, ncol(etf_vix))

#----------------------------------

(bvhar_spec_v2 <- set_weight_bvhar(sig, lam, eps, day, week, month))

#> Model Specification for BVHAR

#>

#> Parameters: Coefficent matrice and Covariance matrix

#> Prior: MN_VHAR

#> # Type '?bvhar_minnesota' in the console for some help.

#> ========================================================

#>

#> Setting for 'sigma':

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 3.77 10.63 3.81 4.39 5.99 2.27 4.88 7.45

#> VXEWZCLS

#> 7.03

#>

#> Setting for 'lambda':

#> [1] 0.3

#>

#> Setting for 'eps':

#> [1] 1e-04

#>

#> Setting for 'daily':

#> [1] 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

#>

#> Setting for 'weekly':

#> [1] 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

#>

#> Setting for 'monthly':

#> [1] 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

mod_bvhar_v2 <- bvhar_minnesota(y = etf_tr, bayes_spec = bvhar_spec_v2)

MSE:

forecast_bvhar_v2 <- predict(mod_bvhar_v2, h)

(msebvhar_v2 <- mse(forecast_bvhar_v2, etf_te))

#> GVZCLS OVXCLS VXFXICLS VXEEMCLS VXSLVCLS EVZCLS VXXLECLS VXGDXCLS

#> 3.63 4.39 1.37 5.63 6.16 1.19 14.18 2.52

#> VXEWZCLS

#> 5.23

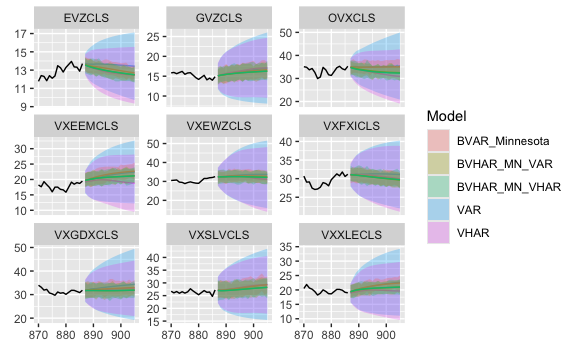

Plots

autoplot(forecast_var, x_cut = 870, ci_alpha = .7, type = "wrap") +

autolayer(forecast_vhar, ci_alpha = .6) +

autolayer(forecast_bvar, ci_alpha = .4) +

autolayer(forecast_bvhar_v1, ci_alpha = .2) +

autolayer(forecast_bvhar_v2, ci_alpha = .1)

Citation

Please cite this package with following BibTeX:

@Manual{,

title = {{bvhar}: Bayesian Vector Heterogeneous Autoregressive Modeling},

author = {Young Geun Kim and Changryong Baek},

year = {2023},

note = {R package version 2.0.1},

url = {https://cran.r-project.org/package=bvhar},

}

@Article{,

title = {Bayesian Vector Heterogeneous Autoregressive Modeling},

author = {Young Geun Kim and Changryong Baek},

journal = {Journal of Statistical Computation and Simulation},

year = {2023},

doi = {10.1080/00949655.2023.2281644},

}

Code of Conduct

Please note that the bvhar project is released with a Contributor Code of Conduct. By contributing to this project, you agree to abide by its terms.