Energy Trading and Risk Management.

etrm: Energy Trading and Risk Management

Overview

etrm is an R package with tools for trading and financial risk management in energy markets. The package currently offer tools for two main activities:

- Construction of forward market curves

- Portfolio insurance trading strategies for energy price risk management

Installation

The development version can be installed from GitHub with:

devtools::install_github("sleire/etrm")

Examples of use

The following sections provide examples using some of the synthetic data sets included in the package.

1. The Maximum Smoothness Forward Curve

A typical characteristic of energy commodities such as electricity and natural gas is that delivery takes place over a period in time, not on a single date. Listed futures contracts cover standardized periods, such as “Week”, “Month”, “Quarter”, “Season” or “Year”. The forward curve is an essential tool for pricing non-standard OTC contracts having any settlement period. An example of such standard energy market contracts can be found in the package data set powfutures130513.

#> Include Contract Start End Closing

#> 1 TRUE W21-13 2013-05-20 2013-05-26 33.65

#> 2 TRUE W22-13 2013-05-27 2013-06-02 35.77

#> 3 TRUE W23-13 2013-06-03 2013-06-09 36.58

#> 4 TRUE W24-13 2013-06-10 2013-06-16 35.93

#> 5 TRUE W25-13 2013-06-17 2013-06-23 33.14

#> 6 TRUE W26-13 2013-06-24 2013-06-30 34.16

#> 7 FALSE MJUN-13 2013-06-01 2013-06-30 35.35

#> 8 TRUE MJUL-13 2013-07-01 2013-07-31 33.14

#> 9 TRUE MAUG-13 2013-08-01 2013-08-31 35.72

#> 10 TRUE MSEP-13 2013-09-01 2013-09-30 38.41

#> 11 TRUE MOCT-13 2013-10-01 2013-10-31 38.81

#> 12 TRUE MNOV-13 2013-11-01 2013-11-30 40.94

#> 13 FALSE Q3-13 2013-07-01 2013-09-30 35.72

#> 14 TRUE Q4-13 2013-10-01 2013-12-31 40.53

#> 15 TRUE Q1-14 2014-01-01 2014-03-31 42.40

#> 16 TRUE Q2-14 2014-04-01 2014-06-30 33.39

#> 17 TRUE Q3-14 2014-07-01 2014-09-30 31.78

#> 18 TRUE Q4-14 2014-10-01 2014-12-31 38.25

#> 19 TRUE Q1-15 2015-01-01 2015-03-31 40.73

#> 20 TRUE Q2-15 2015-04-01 2015-06-30 32.64

#> 21 TRUE Q3-15 2015-07-01 2015-09-30 30.87

#> 22 TRUE Q4-15 2015-10-01 2015-12-31 37.22

#> 23 FALSE CAL-14 2014-01-01 2014-12-31 36.43

#> 24 FALSE CAL-15 2015-01-01 2015-12-31 35.12

#> 25 TRUE CAL-16 2016-01-01 2016-12-31 34.10

#> 26 FALSE CAL-17 2017-01-01 2017-12-31 35.22

#> 27 FALSE CAL-18 2018-01-01 2018-12-31 36.36

#> 28 FALSE CAL-19 2019-01-01 2019-12-31 37.44

#> 29 FALSE CAL-20 2020-01-01 2020-12-31 38.58

#> 30 FALSE CAL-21 2021-01-01 2021-12-31 39.73

#> 31 FALSE CAL-22 2022-01-01 2022-12-31 40.93

#> 32 FALSE CAL-23 2023-01-01 2023-12-31 42.15

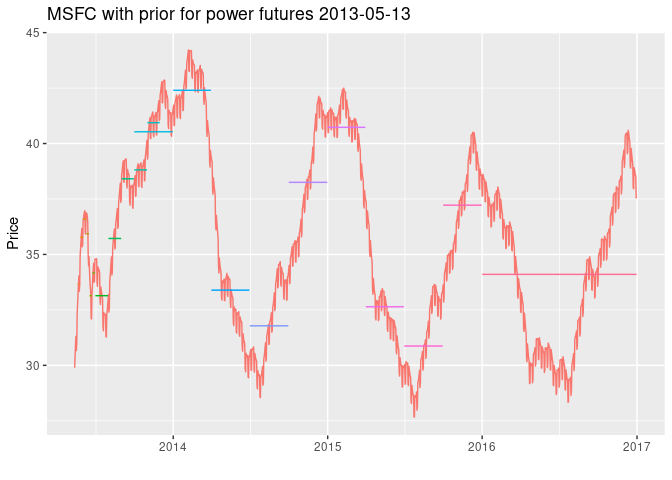

The function msfc() will create an instance of the S4 class MSFC with generic methods plot(), summary() and show(). In addition to the arguments from the list of contracts, the user may also provide a prior function to the calculation. This is relevant for markets with strong seasonality, such as power markets. The default value is prior = 0, but the user can provide any vector expressing a belief regarding the market to be combined with the observed prices. In the example below we have used a simple seasonal prior from the package powpriors130513 data set.

fwd_fut_wpri <- msfc(tdate = as.Date("2013-05-13"), # trading date

include = powfutures130513$Include, # vector with TRUE/FALSE, include contract?

contract = powfutures130513$Contract, # vector with contract names

sdate = powfutures130513$Start, # vector with contract start dates

edate = powfutures130513$End, # vector with contract end dates

f = powfutures130513$Closing, # vector with contract closing prices

prior = powpriors130513$mod.prior # prior function

)

plot(fwd_fut_wpri, legend = "", title = "MSFC with prior for power futures 2013-05-13")

The forward curve is calculated with the function

f(t) = λ(t) + ϵ(t)

where λ(t) is the prior supplied by the user and ϵ(t) is an adjustment function taking the observed prices into account. The msfc() function finds the smoothest possible adjustment function by minimizing the mean squared value of a spline function, while ensuring that the average value of the curve f(t) is equal to contract prices used in the calculation for the respective time intervals. The number of polynomials used in the spline along with head(prior) and computed prices based on the curve are available with the summary() method:

summary(fwd_fut_wpri)

#> $Description

#> [1] "MSFC of length 1329 built with 41 polynomials at trade date 2013-05-13"

#>

#> $PriorFunc

#> [1] 30.10842 30.16396 30.19572 30.16144 29.06268 28.93272

#>

#> $BenchSheet

#> Include Contract From To Price Comp

#> 1 TRUE W21-13 2013-05-20 2013-05-26 33.65 33.65

#> 2 TRUE W22-13 2013-05-27 2013-06-02 35.77 35.77

#> 3 TRUE W23-13 2013-06-03 2013-06-09 36.58 36.58

#> 4 TRUE W24-13 2013-06-10 2013-06-16 35.93 35.93

#> 5 TRUE W25-13 2013-06-17 2013-06-23 33.14 33.14

#> 6 TRUE W26-13 2013-06-24 2013-06-30 34.16 34.16

#> 8 TRUE MJUL-13 2013-07-01 2013-07-31 33.14 33.14

#> 9 TRUE MAUG-13 2013-08-01 2013-08-31 35.72 35.72

#> 10 TRUE MSEP-13 2013-09-01 2013-09-30 38.41 38.41

#> 11 TRUE MOCT-13 2013-10-01 2013-10-31 38.81 38.81

#> 12 TRUE MNOV-13 2013-11-01 2013-11-30 40.94 40.94

#> 14 TRUE Q4-13 2013-10-01 2013-12-31 40.53 40.53

#> 15 TRUE Q1-14 2014-01-01 2014-03-31 42.40 42.40

#> 16 TRUE Q2-14 2014-04-01 2014-06-30 33.39 33.39

#> 17 TRUE Q3-14 2014-07-01 2014-09-30 31.78 31.78

#> 18 TRUE Q4-14 2014-10-01 2014-12-31 38.25 38.25

#> 19 TRUE Q1-15 2015-01-01 2015-03-31 40.73 40.73

#> 20 TRUE Q2-15 2015-04-01 2015-06-30 32.64 32.64

#> 21 TRUE Q3-15 2015-07-01 2015-09-30 30.87 30.87

#> 22 TRUE Q4-15 2015-10-01 2015-12-31 37.22 37.22

#> 25 TRUE CAL-16 2016-01-01 2016-12-31 34.10 34.10

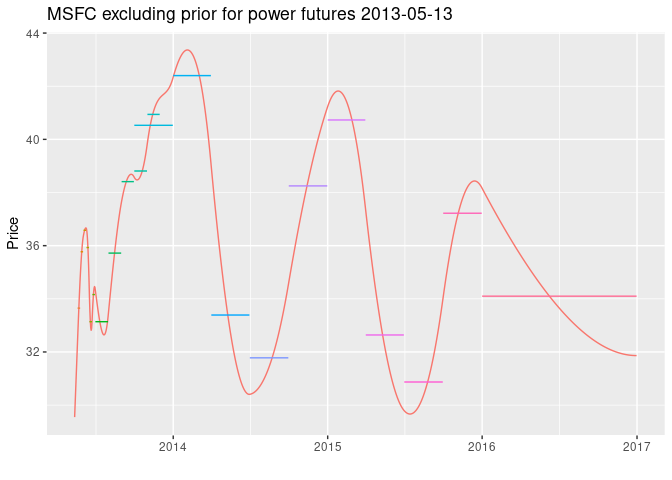

The calculation without prior function, for comparison:

fwd_fut_npri <- msfc(tdate = as.Date("2013-05-13"), # trading date

include = powfutures130513$Include, # vector with TRUE/FALSE, include contract?

contract = powfutures130513$Contract, # vector with contract names

sdate = powfutures130513$Start, # vector with contract start dates

edate = powfutures130513$End, # vector with contract end dates

f = powfutures130513$Closing, # vector with contract closing prices

prior = 0 # no prior function

)

plot(fwd_fut_npri, legend = "", title = "MSFC excluding prior for power futures 2013-05-13")

The daily forward curve values can be found along with the prior function and contracts used in the calculation with the show() method. An instance of MSFC is a rather rich object, and further details regarding the calculation, spline coefficients, etc. can be found in the slots:

slotNames(fwd_fut_wpri)

#> [1] "Name" "TradeDate" "BenchSheet" "Polynomials" "PriorFunc"

#> [6] "Results" "SplineCoef" "KnotPoints" "CalcDat"

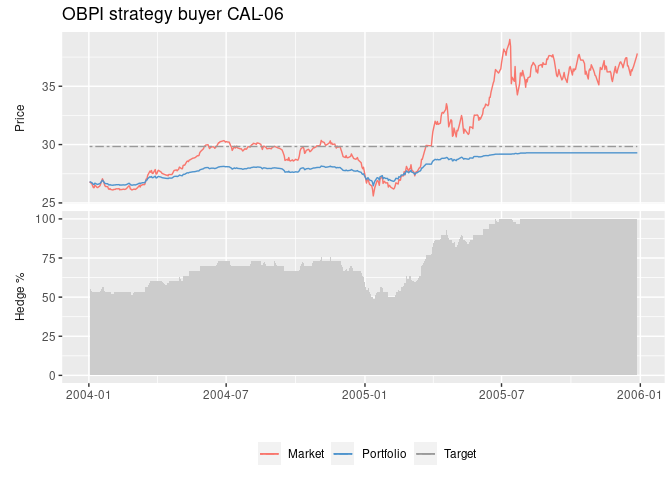

2. Portfolio Insurance Trading Strategies for Energy Price Risk Management

Futures trading strategies for price risk management, for commercial hedgers with long or short exposure. All models below aim to achieve a favorable unit price for the energy portfolio, while preventing it from breaching a pre defined cap (floor).

The functions

cppi()- Constant Proportion Portfolio Insurancedppi()- Dynamic Proportion Portfolio Insuranceobpi()- Option Based Portfolio Insuranceshpi()- Step Hedge Portfolio Insuranceslpi()- Stop Loss Portfolio Insurance

implement alternative approaches to achieve this goal. They return S4 objects of type CPPI, DPPI, OBPI, SHPI and SLPI respectively, with methods plot(), summary() and show().

In our example, we will consider the CAL-06 contract in the synthetic powcal data set, and start trading 500 days prior to the contract expiry. For the OBPIstrategy presented below, the target price is calculated as an expected cap (floor) given by the option premium-adjusted strike price selected for the delta hedging scheme within a standard Black-76 option pricing framework. The default strike price is set at-the-money. The user may express a view regarding future market development by deviating from this level.

cal06_obpi_b <- obpi(q = 30, # volume 30 MW (buyer)

tdate = dat06$Date, # vector with trading days until expiry

f = dat06$CAL06, # vector with futures price

k = dat06$CAL06[1], # default option strike price at-the-money

vol = 0.2, # annualized volatility, for the Black-76 delta hedging

r = 0, # default assumed risk free rate of interest

tdays = 250, # assumed trading days per year

daysleft = 500, # number of days to expiry

tcost = 0, # transaction cost

int = TRUE # integer restriction, smallest transacted unit = 1

)

plot(cal06_obpi_b, legend = "bottom", title = "OBPI strategy buyer CAL-06")

The summary() method:

summary(cal06_obpi_b)

#> $Description

#> [1] "Hedging strategy of type OBPI and length 500"

#>

#> $Volume

#> [1] 30

#>

#> $Target

#> [1] 29.83626

#>

#> $ChurnRate

#> [1] 4.333333

#>

#> $Stats

#> Market Trade Exposed Position Hedge Target Portfolio

#> First 26.82 17 13 17 0.5666667 29.83626 26.82000

#> Max 39.01 17 17 30 1.0000000 29.83626 29.29433

#> Min 25.60 -3 0 13 0.4333333 29.83626 26.46833

#> Last 37.81 0 0 30 1.0000000 29.83626 29.29433

The show()method provide details regarding daily values for market price, transactions, exposed volume, futures contract position, the target price and the calculated portfolio price. Further details for a specific instance of a trading strategy can be found in the slots, see for example:

slotNames(cal06_obpi_b)

#> [1] "StrikePrice" "AnnVol" "InterestRate" "TradingDays" "Name"

#> [6] "Volume" "TargetPrice" "TransCost" "TradeisInt" "Results"

The CAL-06 OBPI strategy from a sellers point of view:

cal06_obpi_s <- obpi(q = - 30, # volume -30 MW (seller)

tdate = dat06$Date, # vector with trading days until expiry

f = dat06$CAL06, # vector with futures price

k = dat06$CAL06[1], # default option strike price at-the-money

vol = 0.2, # annualized volatility, for the Black-76 delta hedging

r = 0, # default assumed risk free rate of interest

tdays = 250, # assumed trading days per year

daysleft = 500, # number of days to expiry

tcost = 0, # transaction cost

int = TRUE # integer restriction, smallest transacted unit = 1

)

plot(cal06_obpi_s, legend = "bottom", title = "OBPI strategy seller CAL-06")