Description

Learning Graphs for Financial Markets.

Description

Learning graphs for financial markets with optimization algorithms. This package contains implementations of the algorithms described in the paper: Cardoso JVM, Ying J, and Palomar DP (2021) <https://papers.nips.cc/paper/2021/hash/a64a034c3cb8eac64eb46ea474902797-Abstract.html> "Learning graphs in heavy-tailed markets", Advances in Neural Informations Processing Systems (NeurIPS).

README.md

fingraph

This repo contains ADMM implementations to estimate weighted undirected graphs (Markov random fields) under Student-t assumptions with applications to financial markets.

Installation

fingraph depends on the development version of spectralGraphTopology.

You can install the development version from GitHub:

> devtools::install_github("mirca/spectralGraphTopology")

> devtools::install_github("mirca/fingraph")

Microsoft Windows

On MS Windows environments, make sure to install the most recent version of Rtools.

Usage

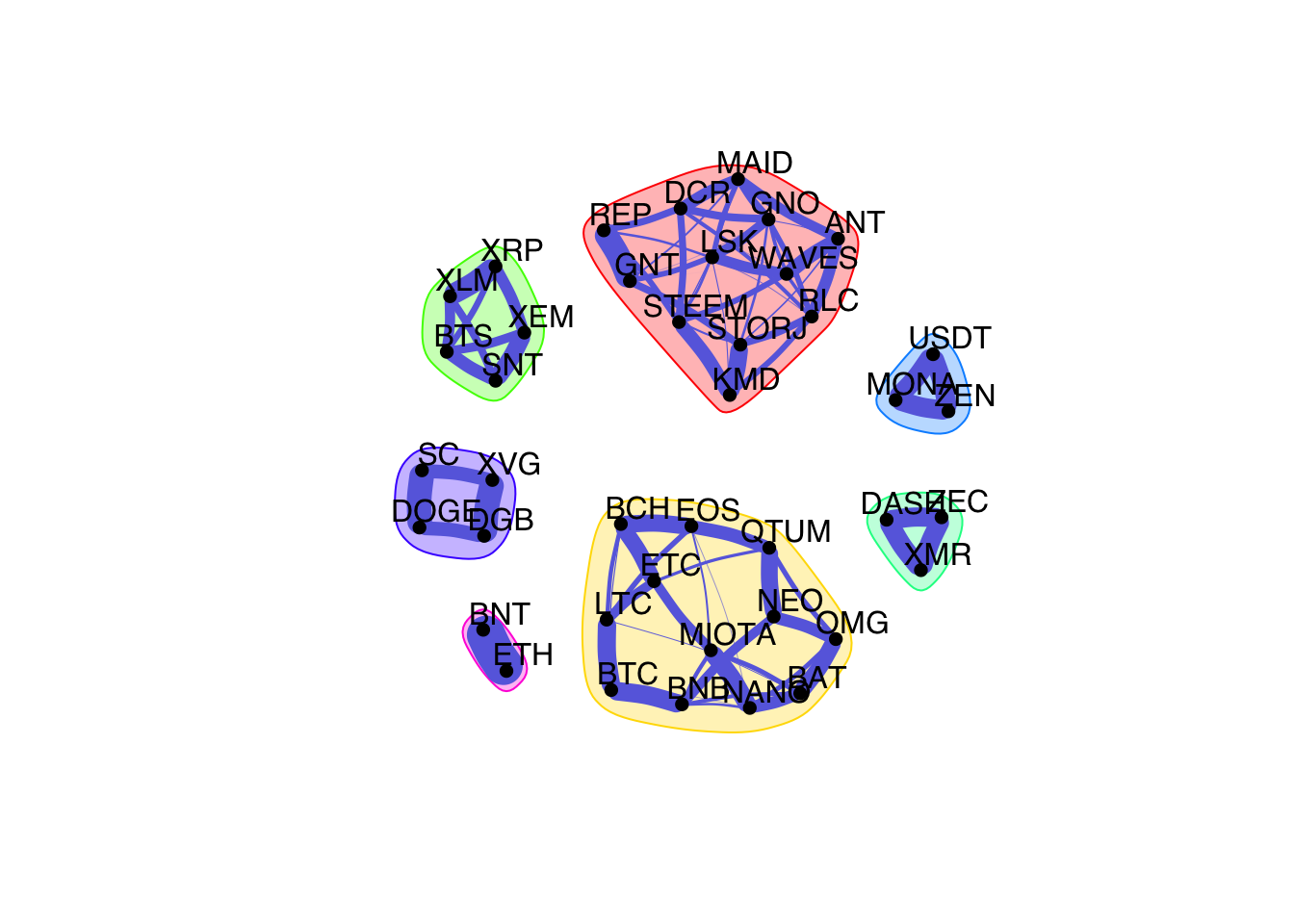

Learning a graph of cryptocurrencies

library(igraph)

library(fingraph)

library(fitHeavyTail)

library(xts)

set.seed(123)

# load crypto prices into an xts table

crypto_prices <- readRDS("examples/crypto/crypto-prices.rds")

colnames(crypto_prices)

#> [1] "BTC" "ETH" "XRP" "USDT" "LTC" "BCH" "BNB" "XLM" "EOS"

#> [10] "XMR" "XEM" "NEO" "DASH" "WAVES" "MIOTA" "ZEC" "ETC" "GNO"

#> [19] "OMG" "DOGE" "BAT" "DCR" "DGB" "QTUM" "REP" "LSK" "SC"

#> [28] "NANO" "ANT" "SNT" "ZEN" "MAID" "GNT" "XVG" "BNT" "MONA"

#> [37] "RLC" "STORJ" "STEEM" "KMD" "BTS"

# compute log-returns

log_returns <- diff(log(crypto_prices), na.pad = FALSE)

# estimate a weighted, undirected graph (markov random field)

graph_mrf <- learn_kcomp_heavytail_graph(scale(log_returns),

k = 7,

heavy_type = "student",

nu = fit_mvt(scale(log_returns),

nu="MLE-diag-resample")$nu,

verbose = FALSE)

# plot network

net <- graph_from_adjacency_matrix(graph_mrf$adjacency,

mode = "undirected",

weighted = TRUE)

cfg <- cluster_fast_greedy(as.undirected(net))

la_kcomp <- layout_nicely(net)

V(net)$label.cex = 1

plot(cfg, net, vertex.label = colnames(crypto_prices),

layout = la_kcomp,

vertex.size = 4.5,

col = "black",

edge.color = c("#686de0"),

vertex.label.family = "Helvetica",

vertex.label.color = "black",

vertex.label.dist = 1.25,

vertex.shape = "circle",

edge.width = 20*E(net)$weight,

edge.curved = 0.1)

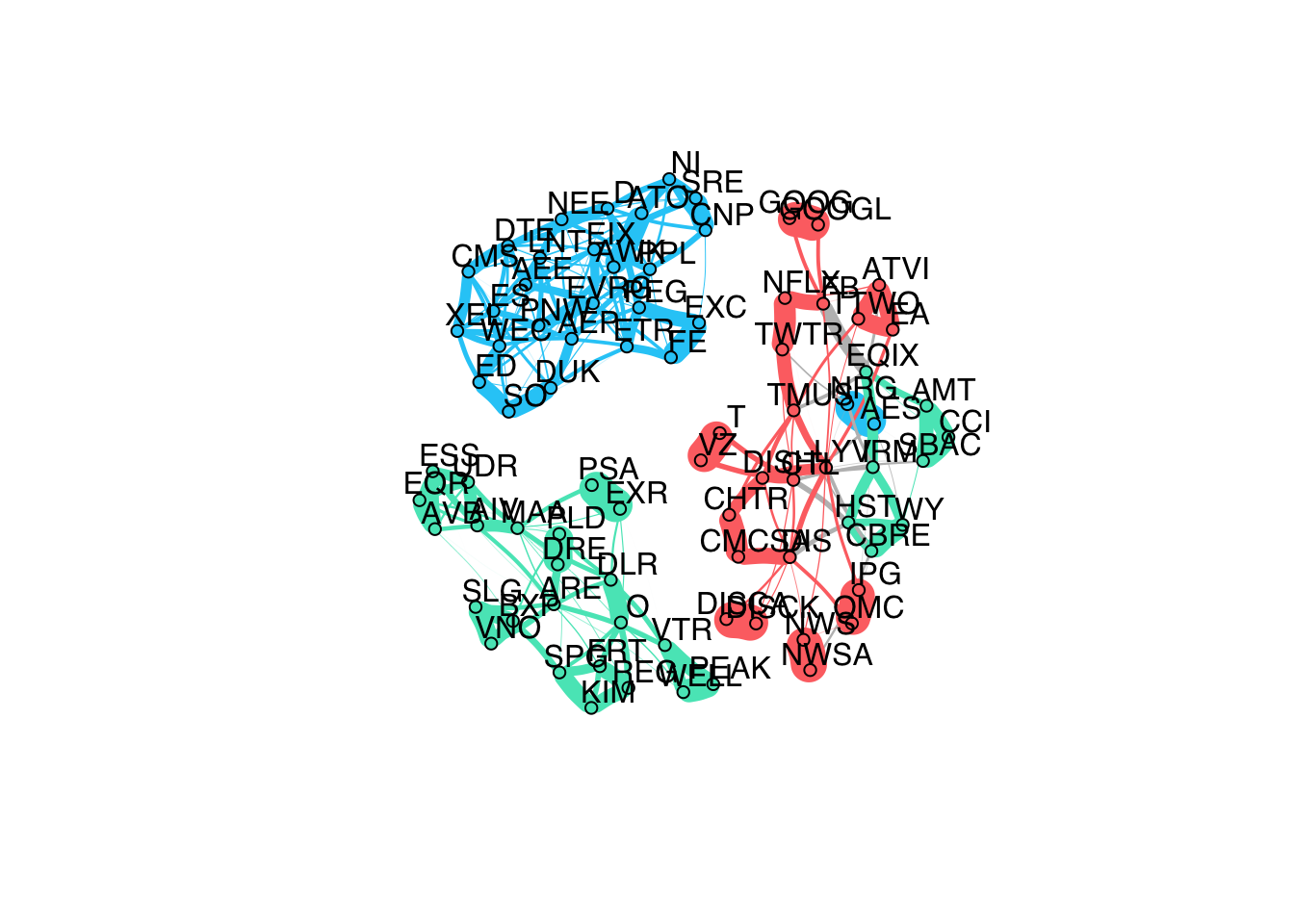

Learning a network of S&P500 stocks

library(xts)

library(igraph)

library(fingraph)

library(fitHeavyTail)

library(readr)

set.seed(123)

# load table w/ stocks and their sectors

SP500 <- read_csv("examples/stocks/SP500-sectors.csv")

# load stock prices into an xts table

stock_prices <- readRDS("examples/stocks/stock-data-2014-2018.rds")

colnames(stock_prices)

#> [1] "AEE" "AEP" "AES" "AIV" "AMT" "ARE" "ATO" "ATVI" "AVB"

#> [10] "AWK" "BXP" "CBRE" "CCI" "CHTR" "CMCSA" "CMS" "CNP" "CTL"

#> [19] "D" "DIS" "DISCA" "DISCK" "DISH" "DLR" "DRE" "DTE" "DUK"

#> [28] "EA" "ED" "EIX" "EQIX" "EQR" "ES" "ESS" "ETR" "EVRG"

#> [37] "EXC" "EXR" "FB" "FE" "FRT" "GOOG" "GOOGL" "HST" "IPG"

#> [46] "IRM" "KIM" "LNT" "LYV" "MAA" "NEE" "NFLX" "NI" "NRG"

#> [55] "NWS" "NWSA" "O" "OMC" "PEAK" "PEG" "PLD" "PNW" "PPL"

#> [64] "PSA" "REG" "SBAC" "SLG" "SO" "SPG" "SRE" "T" "TMUS"

#> [73] "TTWO" "TWTR" "UDR" "VNO" "VTR" "VZ" "WEC" "WELL" "WY"

#> [82] "XEL"

# compute log-returns

log_returns <- diff(log(stock_prices), na.pad = FALSE)

# estimate a weighted, undirected graph (markov random field)

graph_mrf <- learn_kcomp_heavytail_graph(scale(log_returns),

rho = 10,

k = 3,

heavy_type = "student",

nu = fit_mvt(scale(log_returns),

nu="MLE-diag-resample")$nu,

verbose = FALSE)

#> Warning in tclass.xts(x): index does not have a 'tclass' attribute

#> Warning in tclass.xts(x): index does not have a 'tclass' attribute

# map stock names and sectors

stock_sectors <- c(SP500$GICS.Sector[SP500$Symbol %in% colnames(stock_prices)])

stock_sectors_index <- as.numeric(as.factor(stock_sectors))

# plot network

net <- graph_from_adjacency_matrix(graph_mrf$adjacency,

mode = "undirected",

weighted = TRUE)

la_kcomp <- layout_nicely(net)

V(net)$label.cex = 1

colors <- c("#FD7272", "#55E6C1", "#25CCF7")

V(net)$color <- colors[stock_sectors_index]

V(net)$type <- stock_sectors_index

V(net)$cluster <- stock_sectors_index

E(net)$color <- apply(as.data.frame(get.edgelist(net)), 1,

function(x) ifelse(V(net)$cluster[x[1]] == V(net)$cluster[x[2]],

colors[V(net)$cluster[x[1]]], 'grey'))

plot(net, vertex.label = colnames(stock_prices),

layout = la_kcomp,

vertex.size = 4.5,

vertex.label.family = "Helvetica",

vertex.label.dist = 1.25,

vertex.label.color = "black",

vertex.shape = "circle",

edge.width = 20*E(net)$weight,

edge.curved = 0.1)

Citation

If you made use of this software please consider citing:

- J. V. de M. Cardoso, J. Ying, D. P. Palomar (2021). Graphical Models in Heavy-Tailed Markets. Advances in Neural Information Processing Systems (NeurIPS’21).