Fixed Income Models, Calculations, Data Structures and Instruments.

fixedincome

Calculations involving interest rates are usually very easy and straightforward, but sometimes it involves specific issues that makes the task of writing structured and reproducible code for it chalenging and annoying. The fixedincome package brings many functions to strucutre and create facilities to handle with interest rates, term structure of interest rates and specific issues regarding compounding rates and day count rules, for example.

Below there are a few examples on how to create and make calculations with interest rates using fixedincome.

Installation

You can install from CRAN with:

install.packages("fixedincome")

You can install the development version of fixedincome from GitHub with:

# install.packages("devtools")

devtools::install_github("wilsonfreitas/R-fixedincome")

Examples

To create an interest rate we need to specify 4 elements:

- the value of the interest rate itself, a decimal number

- the compounding regime of interest rate, that can be

simple,discreteorcontinuous. - the day count rule which defines how interest is accrued over time, we have a few options, for example,

actual/360where the days between two dates are calculated as the difference and the year is assumed to be 360 days. - the calendar used to count the number of days between two dates, we have

actualcalendar that compute the difference between two dates.

There is another important topic that wasn’t declared here that is the frequency of interest. To start with the things simple fixedincome handles only with annual rates since this represents the great majority of rates used in financial market contracts, but this restriction can be reviewed in the future.

Given that let’s declare an annual spot rate with a simple compounding, an actual/360 and the actual calendar.

library(fixedincome)

sr <- spotrate(0.06, "simple", "actual/360", "actual")

sr

#> [1] "0.06 simple actual/360 actual"

Compound the spot rate for 7 months.

compound(sr, 7, "months")

#> [1] 1.035

Also compound using dates.

compound(sr, as.Date("2022-02-23"), as.Date("2022-12-28"))

#> [1] 1.051333

Spot rates can be put inside data.frames.

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:fixedincome':

#>

#> first, last

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, union

library(fixedincome)

df <- tibble(

rate = spotrate(rep(10.56 / 100, 5),

compounding = "discrete",

daycount = "business/252",

calendar = "Brazil/ANBIMA"

),

terms = term(1:5, "years")

)

df

#> # A tibble: 5 x 2

#> rate terms

#> <SpotRate> <Term>

#> 1 0.1056 discrete business/252 Brazil/ANBIMA 1 year

#> 2 0.1056 discrete business/252 Brazil/ANBIMA 2 years

#> 3 0.1056 discrete business/252 Brazil/ANBIMA 3 years

#> 4 0.1056 discrete business/252 Brazil/ANBIMA 4 years

#> 5 0.1056 discrete business/252 Brazil/ANBIMA 5 years

The tidyverse verbs can be easily used with SpotRate and Term classes.

df |> mutate(fact = compound(rate, terms))

#> # A tibble: 5 x 3

#> rate terms fact

#> <SpotRate> <Term> <dbl>

#> 1 0.1056 discrete business/252 Brazil/ANBIMA 1 year 1.11

#> 2 0.1056 discrete business/252 Brazil/ANBIMA 2 years 1.22

#> 3 0.1056 discrete business/252 Brazil/ANBIMA 3 years 1.35

#> 4 0.1056 discrete business/252 Brazil/ANBIMA 4 years 1.49

#> 5 0.1056 discrete business/252 Brazil/ANBIMA 5 years 1.65

Spot rate curves

Let’s create a spot rate curve using web scraping (from B3 website)

source("examples/utils-functions.R")

#>

#> Attaching package: 'bizdays'

#> The following object is masked from 'package:stats':

#>

#> offset

curve <- get_curve_from_web("2022-02-23")

curve

#> SpotRateCurve

#> 1 day 0.1065

#> 3 days 0.1064

#> 25 days 0.1111

#> 44 days 0.1138

#> 66 days 0.1168

#> 87 days 0.1189

#> 108 days 0.1207

#> 131 days 0.1220

#> 152 days 0.1227

#> 172 days 0.1235

#> # ... with 29 more rows

#> discrete business/252 Brazil/ANBIMA

#> Reference date: 2022-02-23

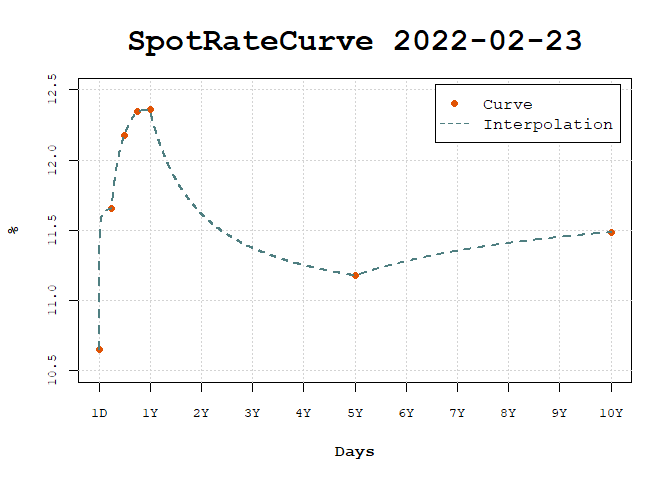

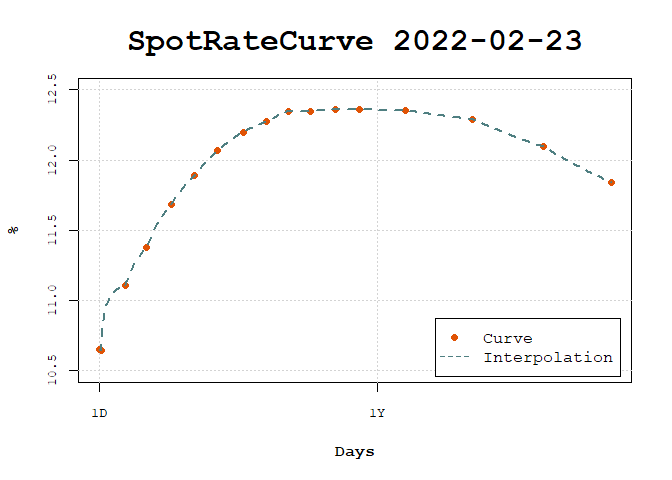

SpotRateCurve plots can be easily done by calling plot.

plot(curve)

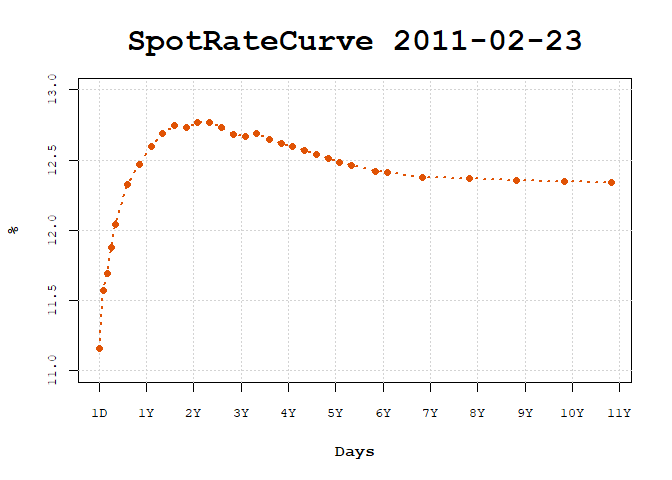

For another date.

curve <- get_curve_from_web("2011-02-23")

plot(curve)

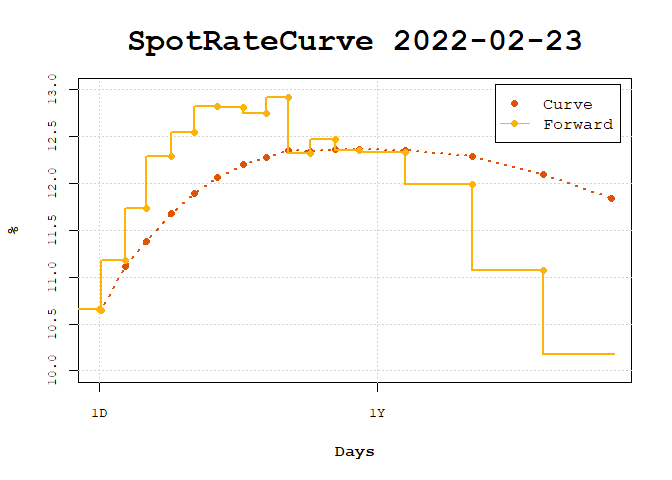

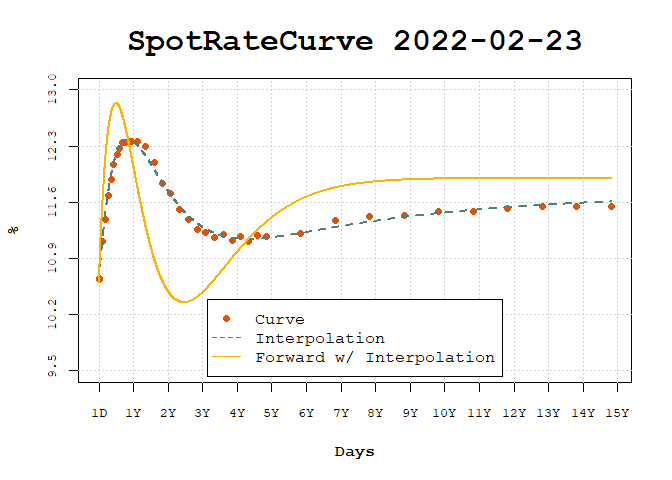

It can show the forward rates for the short term by selecting the first two years.

curve <- get_curve_from_web("2022-02-23")

plot(fixedincome::first(curve, "2 years"), show_forward = TRUE)

Once interpolation is set, it can be used in the plot.

curve_2y <- fixedincome::first(curve, "2 years")

interpolation(curve_2y) <- interp_flatforward()

plot(curve_2y, use_interpolation = TRUE, legend_location = "bottomright")

Parametric models like the Nelson-Siegel-Svensson model can be fitted to the curve.

beta1 <- as.numeric(fixedincome::last(curve, "1 day"))

beta2 <- as.numeric(curve[1]) - beta1

interpolation(curve) <- fit_interpolation(

interp_nelsonsiegelsvensson(beta1, beta2, 0.01, 0.01, 2, 1), curve

)

interpolation(curve)

#> <Interpolation: nelsonsiegelsvensson >

#> Parameters:

#> beta1 beta2 beta3 beta4 lambda1 lambda2

#> 0.119 -0.013 1.000 -0.975 1.195 1.122

Once set to the curve it is used in the plot to show daily forward rates.

plot(curve, use_interpolation = TRUE, show_forward = TRUE, legend_location = "bottom")

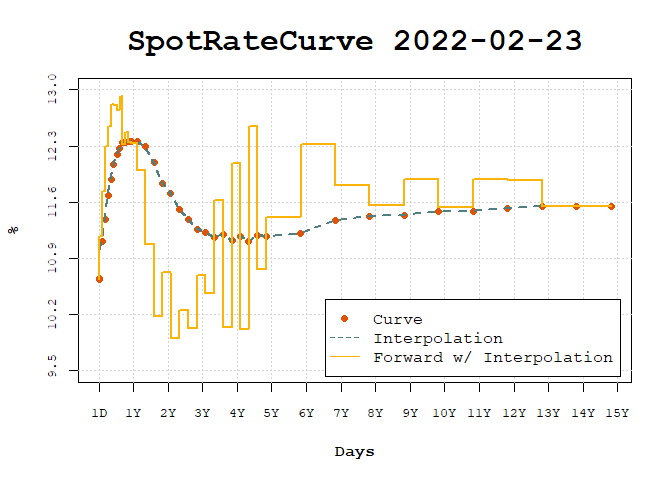

The interpolation can be changed in order to compare different interpolations and the effects in forward rates.

interpolation(curve) <- interp_flatforward()

plot(

curve,

use_interpolation = TRUE, show_forward = TRUE,

legend_location = "bottomright"

)

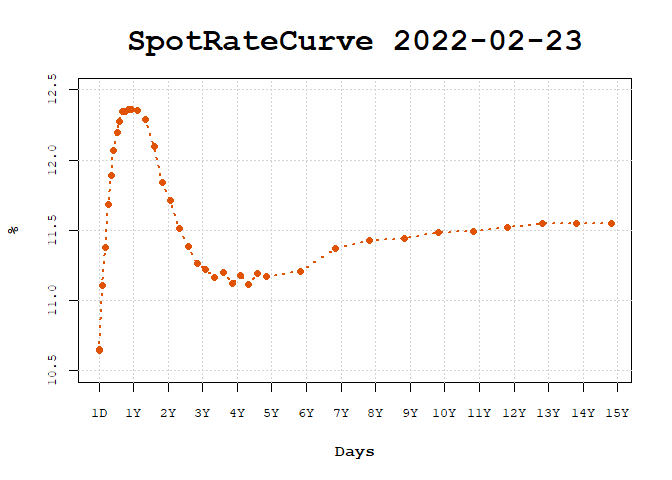

Interpolation enables the creation of standardized curves, commonly used in risk management to build risk factors.

risk_terms <- c(1, c(3, 6, 9) * 21, c(1, 5, 10) * 252)

risk_curve <- curve[[risk_terms]]

interpolation(risk_curve) <- interp_flatforward()

plot(risk_curve, use_interpolation = TRUE)