Modeling and Forecasting Financial Intraday Signals.

intradayModel

Our package uses state-of-the-art state-space models to facilitate the modeling and forecasting of financial intraday signals. It currently offers a univariate model for intraday trading volume, with new features on intraday volatility and multivariate models in development. It is a valuable tool for anyone interested in exploring intraday, algorithmic, and high-frequency trading.

Installation

The package can be installed from GitHub:

# install development version from GitHub

devtools::install_github("convexfi/intradayModel")

Please cite intradayModel in publications:

citation("intradayModel")

Quick Start

To get started, we load our package and sample data: the 15-minute intraday trading volume of AAPL from 2019-01-02 to 2019-06-28, covering 124 trading days. We use the first 104 trading days for fitting, and the last 20 days for evaluation of forecasting performance.

library(intradayModel)

data(volume_aapl)

volume_aapl[1:5, 1:5] # print the head of data

#> 2019-01-02 2019-01-03 2019-01-04 2019-01-07 2019-01-08

#> 09:30 AM 10142172 3434769 20852127 15463747 14719388

#> 09:45 AM 5691840 19751251 13374784 9962816 9515796

#> 10:00 AM 6240374 14743180 11478596 7453044 6145623

#> 10:15 AM 5273488 14841012 16024512 7270399 6031988

#> 10:30 AM 4587159 18041115 8686059 7130980 5479852

volume_aapl_training <- volume_aapl[, 1:104]

volume_aapl_testing <- volume_aapl[, 105:124]

Next, we fit a univariate state-space model using fit_volume() function.

model_fit <- fit_volume(volume_aapl_training)

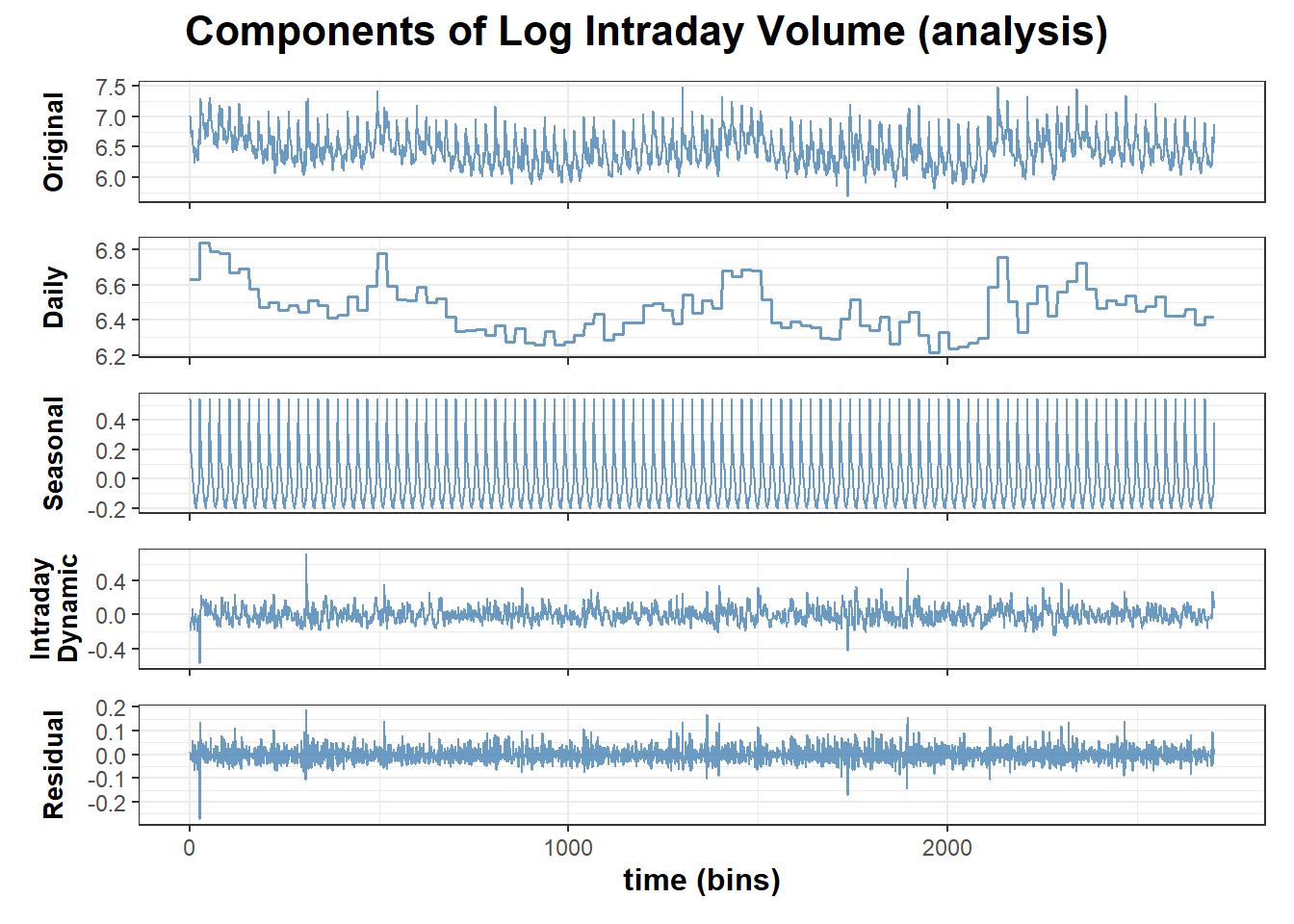

Once the model is fitted, we can analyze the hidden components of any intraday volume based on all its observations. By calling decompose_volume() function with purpose = "analysis", we obtain the smoothed daily, seasonal, and intraday dynamic components. It involves incorporating both past and future observations to refine the state estimates.

analysis_result <- decompose_volume(purpose = "analysis", model_fit, volume_aapl_training)

# visualization

plots <- generate_plots(analysis_result)

plots$log_components

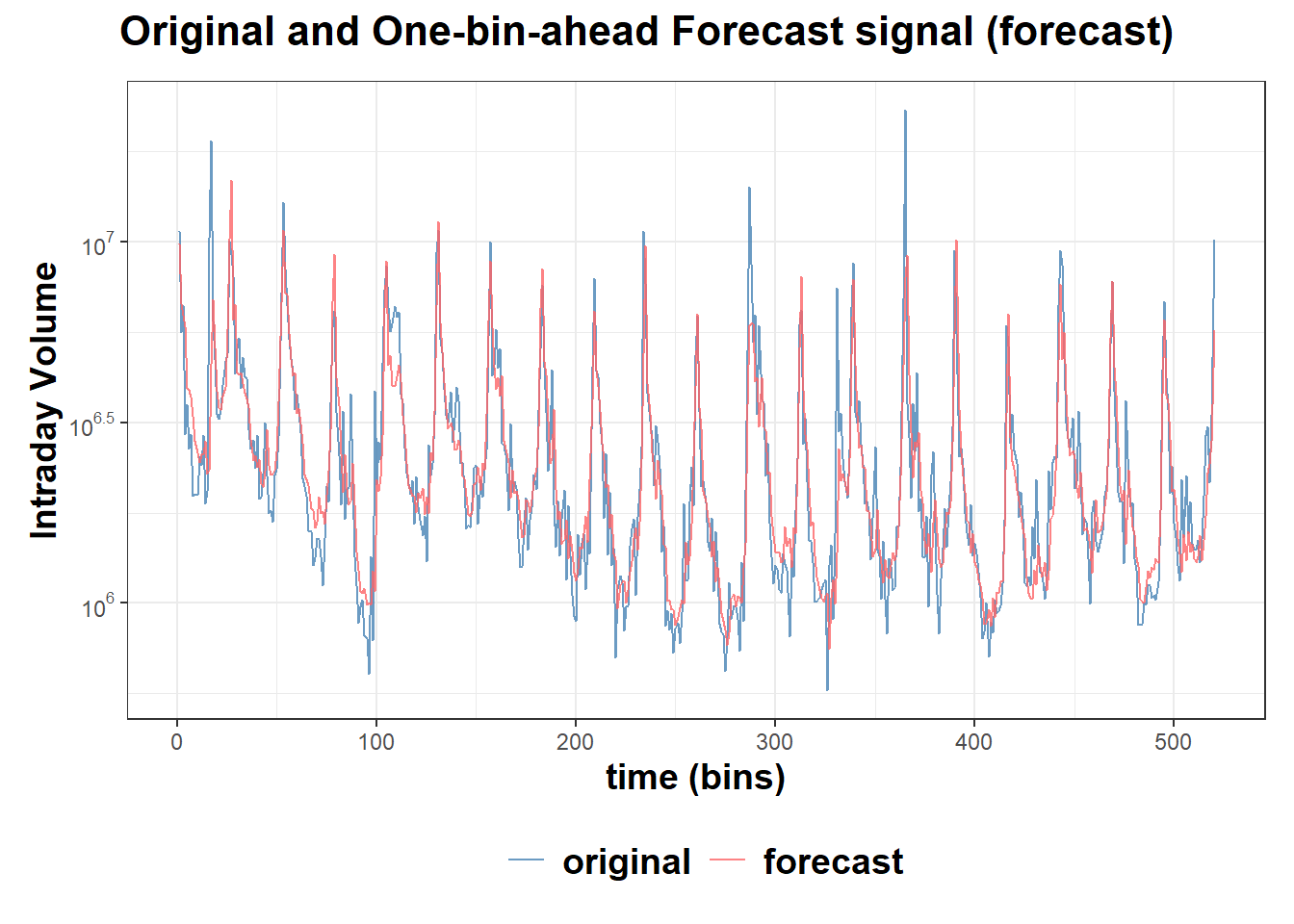

To see how well our model performs on new data, we call forecast_volume() function to do one-bin-ahead forecast on the testing set.

forecast_result <- forecast_volume(model_fit, volume_aapl_testing)

# visualization

plots <- generate_plots(forecast_result)

plots$original_and_forecast

Contributing

We welcome all sorts of contributions. Please feel free to open an issue to report a bug or discuss a feature request.

Citation

If you make use of this software please consider citing:

- Chen, R., Feng, Y., and Palomar, D. (2016). Forecasting intraday trading volume: A Kalman filter approach. https://dx.doi.org/10.2139/ssrn.3101695

Links

Package: GitHub

Vignette: GitHub-vignette.