Automatic Differentiation of Multivariate Operations.

madness

'madness' is a 'Multivariate Automatic Differentiation' package for R. It allows one to compute and track the derivative of multivariate to multivariate functions applied to concrete data via forward differentiation and the chain rule. The obvious use cases are for computing approximate standard errors via the Delta method, possibly for optimization of objective functions over vectors of parameters, and party tricks.

-- Steven E. Pav, [email protected]

Installation

This package can be installed from CRAN, via drat, or from github:

# via CRAN:

install.packages("madness")

# via drat:

if (require(drat)) {

drat:::add("shabbychef")

install.packages("madness")

}

# via devtools (typically 'master' is stable):

if (require(devtools)) {

install_github("shabbychef/madness")

}

Basic Usage

You can store an initial value in a madness object, its derivative with respect to the independent variable, along with the 'name' of the dependent and independent variables, and an optional variance-covariance matrix of the independent variable. These are mostly filled in with sane defaults (the derivative defaults to the identity matrix, and so on):

require(madness)

set.seed(1234)

x <- matrix(rnorm(16), ncol = 2)

madx <- madness(x, vtag = "y", xtag = "x")

# the show method could use some work

print(madx)

## class: madness

## d y

## calc: -----

## d x

## val: -1.2 -0.56 ...

## dvdx: 1 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 ...

## varx: ...

You can then perform operations on objects and the derivative will be propagated forward via the chain rule:

madx2 <- cbind(crossprod(2 * madx), diag(2))

print(madx2)

## class: madness

## d cbind((t((numeric * y)) %*% (numeric * y)), numeric)

## calc: --------------------------------------------------------

## d x

## val: 37 5.9 1 0 ...

## dvdx: -9.7 2.2 8.7 -19 3.4 4 -4.6 -4.4 0 0 0 0 0 0 0 0 ...

## varx: ...

madx3 <- colSums(madx2)

print(madx3)

## class: madness

## d colSums(cbind((t((numeric * y)) %*% (numeric * y)), numeric))

## calc: -----------------------------------------------------------------

## d x

## val: 43 ...

## dvdx: -12 -1.3 6.8 -23 0.33 4.3 -0.76 -4.8 -4.8 1.1 4.3 -9.4 1.7 2 -2.3 -2.2 ...

## varx: ...

madx4 <- norm(log(abs(1 + madx2^2)), "F")

print(madx4)

## class: madness

## d norm(log(abs((numeric + (cbind((t((numeric * y)) %*% (numeric * y)), numeric) ^ numeric)))), 'f')

## calc: -----------------------------------------------------------------------------------------------------

## d x

## val: 10 ...

## dvdx: -0.87 -0.72 -0.11 -1.6 -0.58 0.21 0.7 -0.26 -1.4 -0.23 0.72 -2.7 -0.031 0.49 -0.0021 -0.56 ...

## varx: ...

Variance-Covariance

You can optionally attach the variance-covariance matrix of the 'X' variable to a madness object. Then the estimated variance-covariance of computed quantities can be retrieved via the vcov method:

set.seed(456)

# create some fake data:

nobs <- 1000

adf <- data.frame(x = rnorm(nobs), y = runif(nobs),

eps = rnorm(nobs))

adf$z <- 2 * adf$x - 3 * adf$y + 0.5 * adf$eps

# perform linear regression on it

lmod <- lm(z ~ x + y, data = adf)

# guess what? you can stuff it into a madness

# directly

amad <- as.madness(lmod)

print(vcov(amad))

## [,1] [,2] [,3]

## [1,] 0.00096 -2.0e-05 -1.4e-03

## [2,] -0.00002 2.5e-04 1.2e-05

## [3,] -0.00145 1.2e-05 2.9e-03

# now, say, take the norm

mynorm <- sqrt(crossprod(amad))

print(mynorm)

## class: madness

## d sqrt((t(val) %*% val))

## calc: --------------------------

## d val

## val: 3.6 ...

## dvdx: 0.0037 0.55 -0.83 ...

## varx: 0.00096 -2e-05 -0.0014 ...

print(vcov(mynorm))

## [,1]

## [1,] 0.0021

Markowitz portfolio

There are two utilities for easily computing madness objects representing the first two moments of an object. Here we use these to compute the Markowitz portfolio of some assets, along with the estimated variance-covariance of the same. Here I first download the monthly simple returns of the Fama French three factors. (Note that you cannot directly invest in these, except arguably 'the market'. The point of the example is to use realistic returns, not provide investing advice.)

# Fama French Data are no longer on Quandl, use my

# homebrew package instead:

if (!require(aqfb.data) && require(devtools)) {

devtools::install_github("shabbychef/aqfb_data")

}

require(aqfb.data)

data(mff4)

ffrets <- 0.01 * as.matrix(mff4[, c("Mkt", "SMB", "HML")])

Now compute the first two moments via twomoments and compute the Markowitz portfolio

# compute first two moments

twom <- twomoments(ffrets)

markowitz <- solve(twom$Sigma, twom$mu)

print(val(markowitz))

## [,1]

## [1,] 2.80

## [2,] 0.33

## [3,] 2.19

print(vcov(markowitz))

## [,1] [,2] [,3]

## [1,] 0.47 -0.18 -0.13

## [2,] -0.18 0.87 -0.14

## [3,] -0.13 -0.14 0.76

wald <- val(markowitz)/sqrt(diag(vcov(markowitz)))

print(wald)

## [,1]

## [1,] 4.07

## [2,] 0.35

## [3,] 2.51

Does that really work?

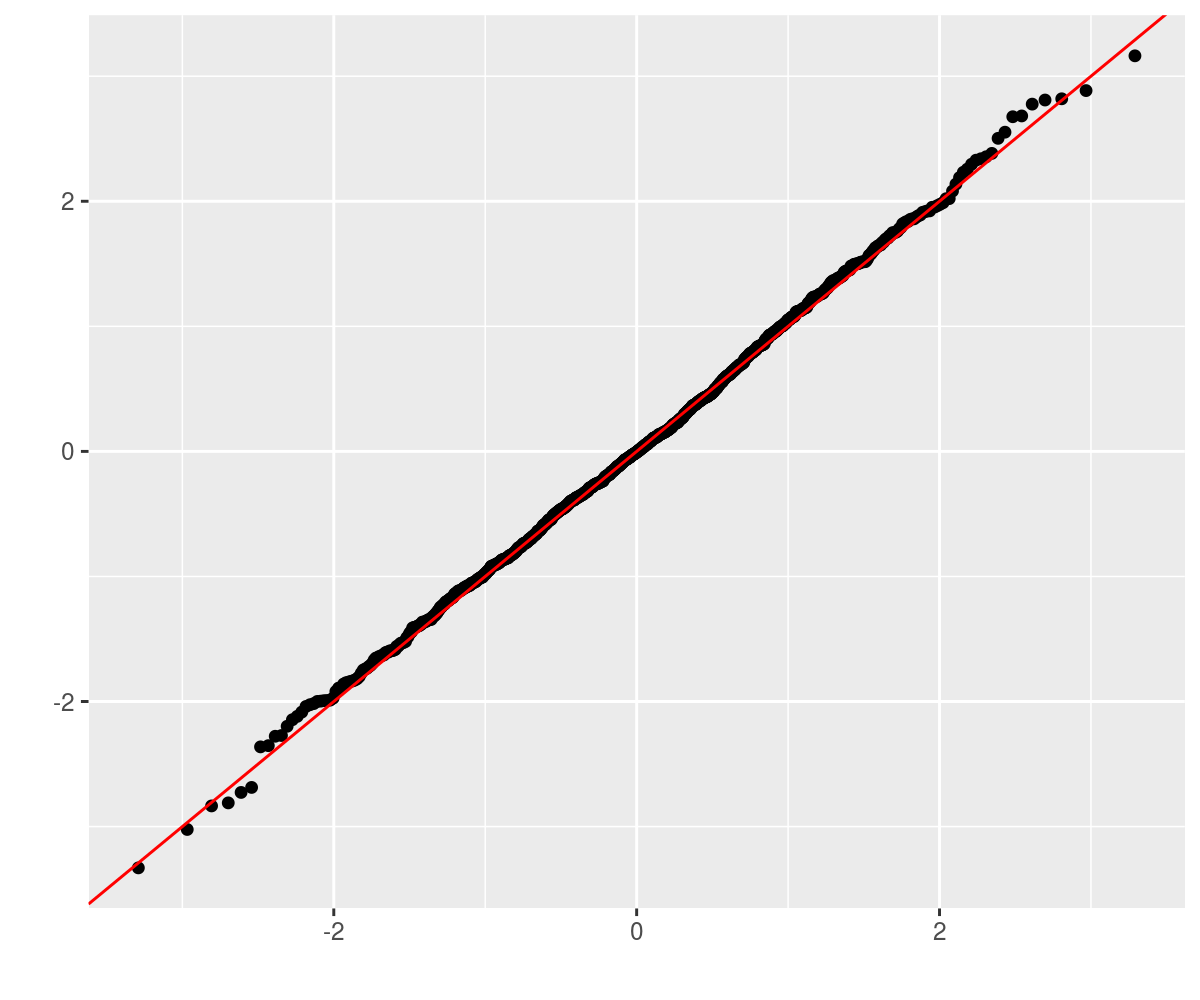

I don't know. Let's perform a bunch of simulations to see if the Wald statistics are OK. We will create a population with 5 stocks where the true Markowitz portfolio is -2,-1,0,1,2. We will perform 1000 simulations of 1250 days of returns from that population, computing the Markowitz portfolio each time. Then take the difference between the estimated and true Markowitz portfolios, divided by the standard errors.

genrows <- function(nsim, mu, haSg) {

p <- length(mu)

X <- matrix(rnorm(nsim * p), nrow = nsim, ncol = p) %*%

haSg

X <- t(rep(mu, nsim) + t(X))

}

true.mp <- array(seq(-2, 2))

dim(true.mp) <- c(length(true.mp), 1)

p <- length(true.mp)

set.seed(92385)

true.Sigma <- 0.00017 * (3/(p + 5)) * crossprod(matrix(runif((p +

5) * p, min = -1, max = 1), ncol = p))

true.mu <- true.Sigma %*% true.mp

haSigma <- chol(true.Sigma)

nsim <- 1000

ndays <- 1250

set.seed(23891)

retv <- replicate(nsim, {

X <- genrows(ndays, true.mu, haSigma)

twom <- twomoments(X)

markowitz <- solve(twom$Sigma, twom$mu)

marginal.wald <- (val(markowitz) - true.mp)/sqrt(diag(vcov(markowitz)))

})

retv <- aperm(retv, c(1, 3, 2))

This should be approximately normal, so we Q-Q plot against normality. LGTM.

require(ggplot2)

ph <- qplot(sample = retv[1, , 1], stat = "qq") + geom_abline(intercept = 0,

slope = 1, colour = "red")

print(ph)

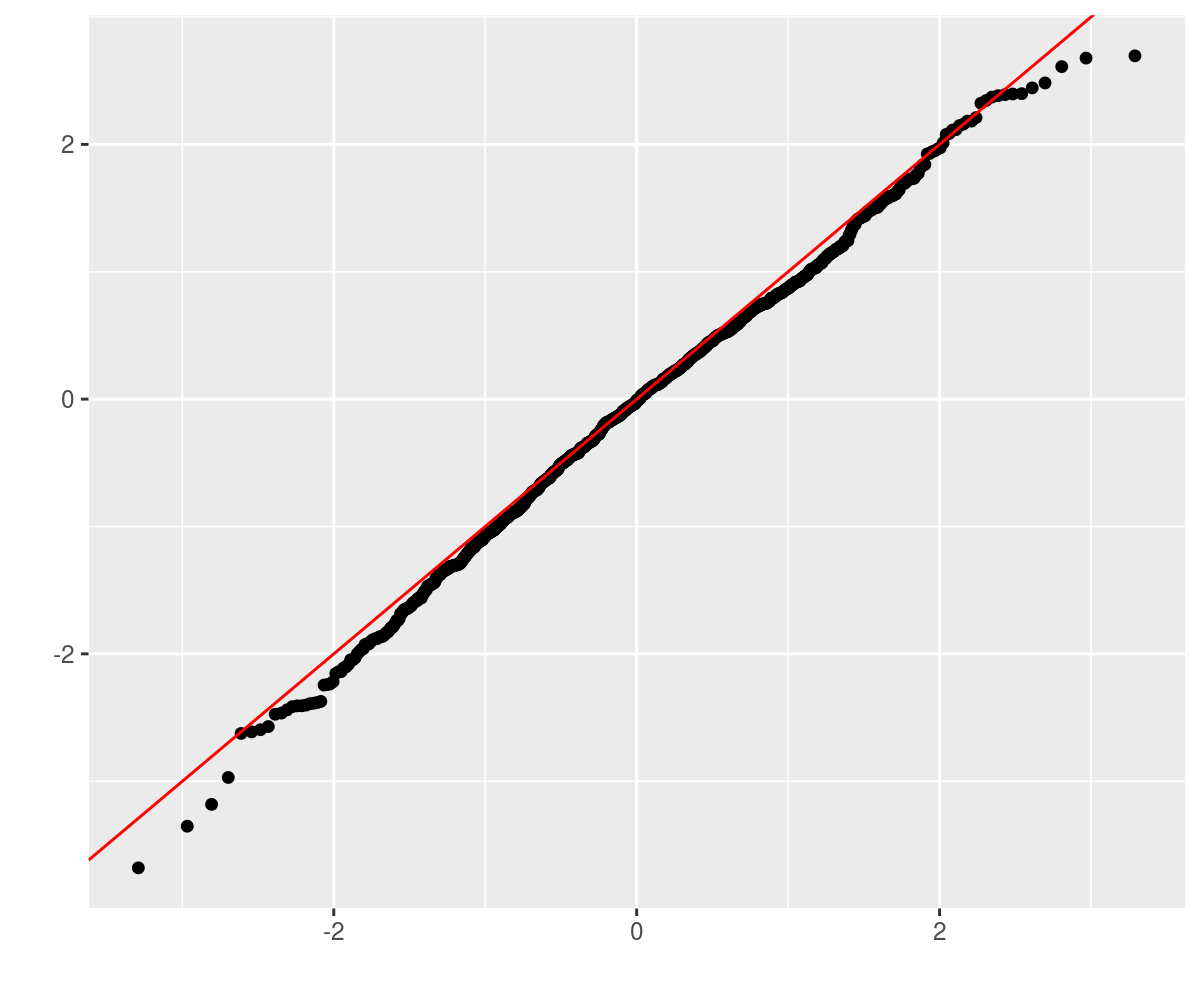

Trace of the covariance matrix

Consider the case of an 8-vector drawn from some population. One observes some fixed number of independent observations of the vector, computes the sample covariance matrix, then computes its trace. Using a madness object, one can automagically estimate the standard error via the delta method. The sample calculation looks as follows:

genrows <- function(nsim, mu, haSg) {

p <- length(mu)

X <- matrix(rnorm(nsim * p), nrow = nsim, ncol = p) %*%

haSg

X <- t(rep(mu, nsim) + t(X))

}

p <- 8

set.seed(8644)

true.mu <- array(rnorm(p), dim = c(p, 1))

true.Sigma <- diag(runif(p, min = 1, max = 20))

true.trace <- matrix.trace(true.Sigma)

haSigma <- chol(true.Sigma)

ndays <- 1250

X <- genrows(ndays, true.mu, haSigma)

twom <- twomoments(X)

matt <- matrix.trace(twom$Sigma)

# Now perform some simulations to see if these are

# accurate:

nsim <- 1000

set.seed(23401)

retv <- replicate(nsim, {

X <- genrows(ndays, true.mu, haSigma)

twom <- twomoments(X, df = 1)

matt <- matrix.trace(twom$Sigma)

marginal.wald <- (val(matt) - true.trace)/sqrt(diag(vcov(matt)))

})

require(ggplot2)

ph <- qplot(sample = as.numeric(retv), stat = "qq") +

geom_abline(intercept = 0, slope = 1, colour = "red")

print(ph)

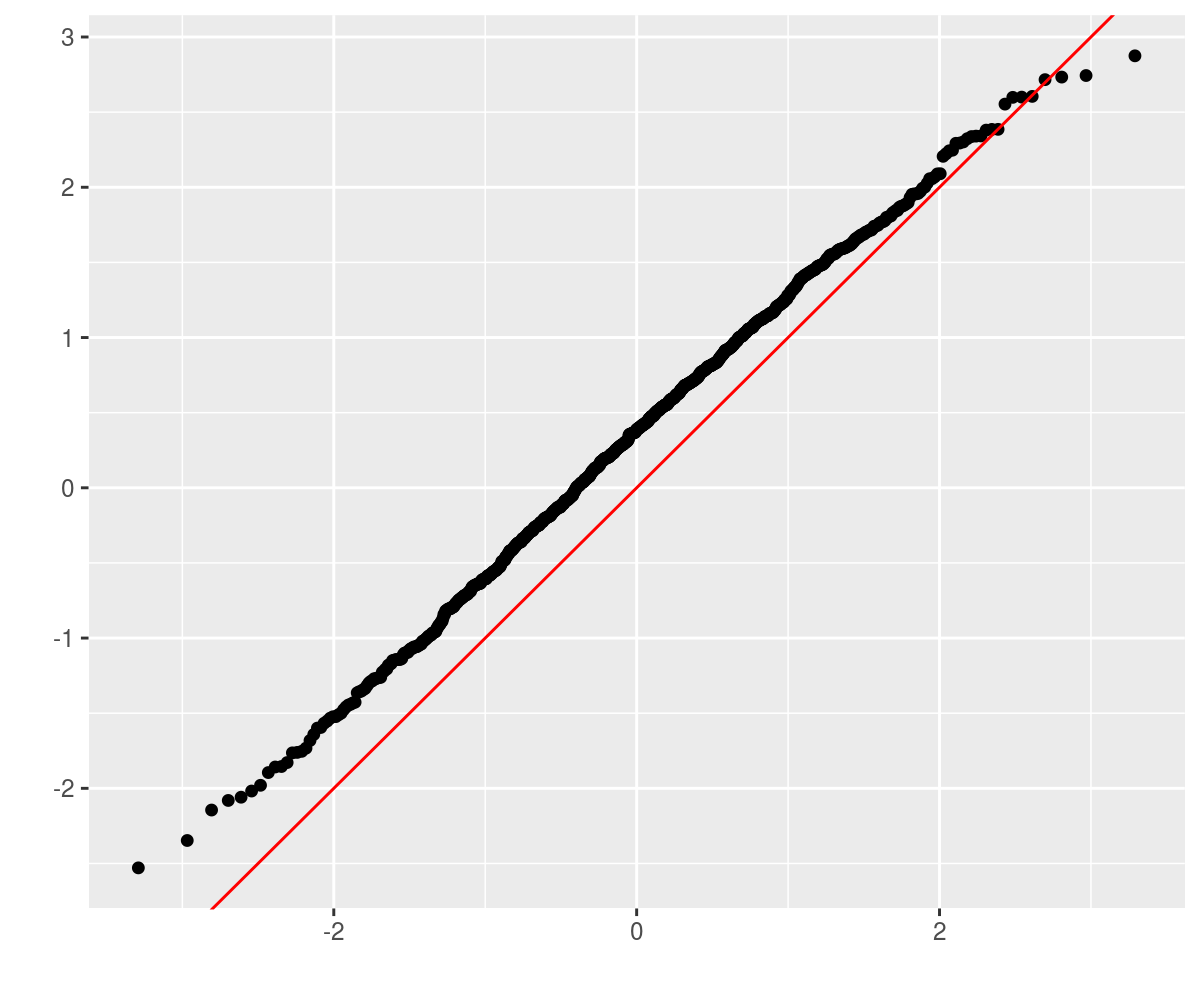

Maximum eigenvalue of the covariance matrix

Consider the case of a 10-vector drawn from a population with covariance matrix whose largest eigenvalue is, say, 17.

One observes some fixed number of independent observations of the 10-vector, and computes the sample covariance matrix, then computes the maximum eigenvalue. Using a madness object, one can automagically estimate the standard error via the delta method. The sample calculation looks as follows:

genrows <- function(nsim, mu, haSg) {

p <- length(mu)

X <- matrix(rnorm(nsim * p), nrow = nsim, ncol = p) %*%

haSg

X <- t(rep(mu, nsim) + t(X))

}

p <- 10

set.seed(123950)

true.mu <- array(rnorm(p), dim = c(p, 1))

true.maxe <- 17

true.Sigma <- diag(c(true.maxe, runif(p - 1, min = 1,

max = 16)))

haSigma <- chol(true.Sigma)

ndays <- 1250

X <- genrows(ndays, true.mu, haSigma)

twom <- twomoments(X, df = 1)

maxe <- maxeig(twom$Sigma)

print(maxe)

## class: madness

## d maxeig(Sigma)

## calc: -----------------

## d X

## val: 18 ...

## dvdx: 0 1.6 0.0068 -0.16 0.05 -0.0065 0.051 -0.0024 0.032 -0.035 -0.049 0.99 0.0086 -0.2 0.063 -0.0081 0.064 -0.003 0.04 -0.044 -0.062 1.9e-05 -0.00087 0.00028 -3.5e-05 0.00028 -1.3e-05 0.00018 -0.00019 -0.00027 0.01 -0.0064 0.00082 -0.0065 0.00031 -0.0041 0.0045 0.0063 0.001 -0.00026 0.0021 -9.6e-05 0.0013 -0.0014 -0.002 1.7e-05 -0.00026 1.2e-05 -0.00017 0.00018 0.00025 0.001 -9.8e-05 0.0013 -0.0014 -0.002 2.3e-06 -6.1e-05 6.7e-05 9.4e-05 0.00041 -9e-04 -0.0013 0.00049 0.0014 0.00097 ...

## varx: 2.4e-34 9.4e-21 4.2e-20 1.8e-20 1.5e-20 -1.1e-20 -1.1e-20 2.6e-20 -7.5e-21 -4.2e-20 -1.6e-20 2e-19 -6e-20 -3e-20 -2e-20 2.3e-20 2.1e-20 -3.9e-20 1.6e-20 6.4e-20 1.5e-20 5.8e-20 -2.5e-20 -4.4e-20 6.4e-20 5.4e-20 -8.8e-20 3.2e-20 1.4e-19 3.5e-20 1.3e-19 -8.1e-21 2.3e-20 6.6e-21 -1.7e-20 1.5e-20 3.8e-20 6.7e-21 1.6e-19 2.3e-20 1.9e-20 -2.8e-20 7.3e-21 5.9e-20 1e-20 6e-21 -2.1e-20 4.3e-20 -1.5e-20 -7.6e-20 -2.3e-20 1.4e-19 2.6e-20 -1.1e-20 -5e-20 -1.7e-20 4.3e-20 1.8e-20 1e-19 2.8e-20 8.9e-20 -3.9e-20 -1.1e-20 -4.4e-20 -4.4e-20 1.4e-20 ...

print(vcov(maxe))

## [,1]

## [1,] 0.53

Now perform some simulations to see if these are accurate:

nsim <- 1000

set.seed(23401)

retv <- replicate(nsim, {

X <- genrows(ndays, true.mu, haSigma)

twom <- twomoments(X, df = 1)

maxe <- maxeig(twom$Sigma)

marginal.wald <- (val(maxe) - true.maxe)/sqrt(diag(vcov(maxe)))

})

require(ggplot2)

ph <- qplot(sample = as.numeric(retv), stat = "qq") +

geom_abline(intercept = 0, slope = 1, colour = "red")

print(ph)

Why the bias? There are a number of possibilities:

- Broken example. Am I really checking what I intended?

- Broken derivative code. Easy to check.

- Failure to take symmetry into account.

- Sample size not large enough. (ha ha.)

- Derivative equal or near zero, requiring second term expansion in delta method.

Enough already, bring me some Scotch!

An example is in order. Consider the tasting data compiled by Nessie on 86 Scotch whiskies. The data are availble online and look like so:

library(curl)

wsky <- read.csv(curl("https://www.mathstat.strath.ac.uk/outreach/nessie/datasets/whiskies.txt"),

stringsAsFactors = FALSE)

kable(head(wsky))

| RowID | Distillery | Body | Sweetness | Smoky | Medicinal | Tobacco | Honey | Spicy | Winey | Nutty | Malty | Fruity | Floral | Postcode | Latitude | Longitude |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Aberfeldy | 2 | 2 | 2 | 0 | 0 | 2 | 1 | 2 | 2 | 2 | 2 | 2 | PH15 2EB | 286580 | 749680 |

| 2 | Aberlour | 3 | 3 | 1 | 0 | 0 | 4 | 3 | 2 | 2 | 3 | 3 | 2 | AB38 9PJ | 326340 | 842570 |

| 3 | AnCnoc | 1 | 3 | 2 | 0 | 0 | 2 | 0 | 0 | 2 | 2 | 3 | 2 | AB5 5LI | 352960 | 839320 |

| 4 | Ardbeg | 4 | 1 | 4 | 4 | 0 | 0 | 2 | 0 | 1 | 2 | 1 | 0 | PA42 7EB | 141560 | 646220 |

| 5 | Ardmore | 2 | 2 | 2 | 0 | 0 | 1 | 1 | 1 | 2 | 3 | 1 | 1 | AB54 4NH | 355350 | 829140 |

| 6 | ArranIsleOf | 2 | 3 | 1 | 1 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 2 | KA27 8HJ | 194050 | 649950 |

A bizarre question one could ask of this data are whether the taste characteristics are related to the geographic coordinates of the distilleries? One way to pose this is to perform a linear regression of the taste values on the geographic coordinates. This is a many-to-many regression. The Multivariate General Linear Hypothesis is a general hypothesis about the regression coefficients in this case. The 'usual' application is the omnibus test of whether all regression coefficients are zero. The MGLH is classically approached by four different tests, which typically give the same answer.

First, we grab the geographic and taste data, prepend a one to the vector, take an outer product and compute the mean and covariance. The MGLH statistics can be posed in terms of the eigenvalues of a certain matrix. Here these are statistics are computed so as to equal zero under the null hypothesis of all zero linear regression coefficient from geography to taste. We get the approximate standard errors from the delta method, and compute Wald statistics.

x <- cbind(1, 1e-05 * wsky[, c("Latitude", "Longitude")])

y <- wsky[, c("Body", "Sweetness", "Smoky", "Medicinal",

"Tobacco", "Honey", "Spicy", "Winey", "Nutty",

"Malty", "Fruity", "Floral")]

xy <- cbind(x, y)

# estimate second moment matrix:

xytheta <- theta(xy)

nfeat <- ncol(x)

ntgt <- ncol(y)

GammaB <- xytheta[1:nfeat, nfeat + (1:ntgt)]

SiB <- -solve(xytheta)[nfeat + (1:ntgt), 1:nfeat]

EH <- SiB %*% GammaB

oEH <- diag(ntgt) + EH

HLT <- matrix.trace(oEH) - ntgt

PBT <- ntgt - matrix.trace(solve(oEH))

# this is not the LRT, but log of 1/LRT. sue me.

LRT <- log(det(oEH))

RLR <- maxeig(oEH) - 1

MGLH <- c(HLT, PBT, LRT, RLR)

walds <- val(MGLH)/sqrt(diag(vcov(MGLH)))

# put them together to show them:

preso <- data.frame(type = c("HLT", "PBT", "LRT", "RLR"),

stat = as.numeric(MGLH), Wald.stat = as.numeric(walds))

kable(preso)

| type | stat | Wald.stat |

|---|---|---|

| HLT | 66.6 | 5.0 |

| PBT | 1.7 | 15.6 |

| LRT | 5.2 | 16.8 |

| RLR | 76.0 | 4.8 |

These all cast doubt on the hypothesis of 'no connection between geography and taste', although I am accustomed to seeing Wald statistics being nearly equivalent. This is still beta code. We also have the estimated standard error covariance of the vector of MGLH statistics, turned into a correlation matrix here. The four test methods have positively correlated standard errors, meaning we should not be more confident if all four suggest rejecting the null.

print(cov2cor(vcov(MGLH)))

## [,1] [,2] [,3] [,4]

## [1,] 1.00 0.15 0.75 0.98

## [2,] 0.15 1.00 0.75 0.11

## [3,] 0.75 0.75 1.00 0.71

## [4,] 0.98 0.11 0.71 1.00

Correctness

The following are cribbed from the unit tests (of which there are never enough). First we define the function which computes approximate derivatives numerically, then test it on some functions:

require(madness)

require(testthat)

apx_deriv <- function(xval, thefun, eps = 1e-09, type = c("forward",

"central")) {

type <- match.arg(type)

yval <- thefun(xval)

dapx <- matrix(0, length(yval), length(xval))

for (iii in seq_len(length(xval))) {

xalt <- xval

xalt[iii] <- xalt[iii] + eps

yplus <- thefun(xalt)

dydx <- switch(type, forward = {

(yplus - yval)/eps

}, central = {

xalt <- xval

xalt[iii] <- xalt[iii] - eps

yneg <- thefun(xalt)

(yplus - yneg)/(2 * eps)

})

dapx[, iii] <- as.numeric(dydx)

}

dapx

}

test_harness <- function(xval, thefun, scalfun = thefun,

eps = 1e-07) {

xobj <- madness(val = xval, vtag = "x", xtag = "x")

yobj <- thefun(xobj)

xval <- val(xobj)

dapx <- apx_deriv(xval, scalfun, eps = eps, type = "central")

# compute error:

dcmp <- dvdx(yobj)

dim(dcmp) <- dim(dapx)

merror <- abs(dapx - dcmp)

rerror <- merror/(0.5 * pmax(sqrt(eps), (abs(dapx) +

abs(dcmp))))

rerror[dapx == 0 & dcmp == 0] <- 0

max(abs(rerror))

}

# now test a bunch:

set.seed(2015)

xval <- matrix(1 + runif(4 * 4), nrow = 4)

yval <- matrix(1 + runif(length(xval)), nrow = nrow(xval))

expect_lt(test_harness(xval, function(x) {

x + x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

x * yval

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

yval/x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

x^x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

x %*% x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

x %*% yval

}), 1e-06)

expect_lt(test_harness(abs(xval), function(x) {

log(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

exp(x)

}), 1e-06)

expect_lt(test_harness(abs(xval), function(x) {

log10(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

sqrt(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

matrix.trace(x)

}, function(matx) {

sum(diag(matx))

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

colSums(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

colMeans(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

vec(x)

}, function(x) {

dim(x) <- c(length(x), 1)

x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

vech(x)

}, function(x) {

x <- x[row(x) >= col(x)]

dim(x) <- c(length(x), 1)

x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

tril(x)

}, function(x) {

x[row(x) < col(x)] <- 0

x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

triu(x)

}, function(x) {

x[row(x) > col(x)] <- 0

x

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

det(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

determinant(x, logarithm = TRUE)$modulus

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

determinant(x, logarithm = FALSE)$modulus

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

colSums(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

colMeans(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

rowSums(x)

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

rowMeans(x)

}), 1e-06)

set.seed(2015)

zval <- matrix(0.01 + runif(4 * 100, min = 0, max = 0.05),

nrow = 4)

xval <- tcrossprod(zval)

expect_lt(test_harness(xval, function(x) {

norm(x, "O")

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

norm(x, "I")

}), 1e-06)

# Matrix::norm does not support type '2'

expect_lt(test_harness(xval, function(x) {

norm(x, "2")

}, function(x) {

base::norm(x, "2")

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

norm(x, "M")

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

norm(x, "F")

}), 1e-06)

expect_lt(test_harness(xval, function(x) {

sqrtm(x)

}), 1e-06)

Symmetry

Some functions implicitly break symmetry, which could cause the differentiation process to fail. For example, the 'chol' function is to be applied to a symmetric matrix, but only looks at the upper triangular part, ignoring the lower triangular part. This is demonstrated below. For the moment, the only 'solution' is to enforce symmetry of the input. Eventually some native functionality around symmetry may be implemented.

set.seed(2015)

zval <- matrix(0.01 + runif(4 * 100, min = 0, max = 0.05),

nrow = 4)

xval <- tcrossprod(zval)

fsym <- function(x) {

0.5 * (x + t(x))

}

# this will fail:

# expect_lt(test_harness(xval,function(x) { chol(x)

# }),1e-6)

expect_gte(test_harness(xval, function(x) {

chol(x)

}), 1.99)

# this will not:

expect_lt(test_harness(xval, function(x) {

chol(fsym(x))

}), 1e-06)

The functions twomoments and theta respect the symmetry of the quantities being estimated.

Warnings

This code is a proof of concept. The methods used to compute derivatives are not (yet) space-efficient or necessarily numerically stable. User assumes all risk.

Derivatives are stored as a matrix in 'numerator layout'. That is the independent and dependent variable are vectorized, then the derivative matrix has the same number of columns as elements in the dependent variable. Thus the derivative of a 3 by 2 by 5 y with respect to a 1 by 2 by 2 x is a 30 by 4 matrix.