Description

Functions to Assess the Business Impact of Churn Prediction Models.

Description

Calculate the financial impact of using a churn model in terms of cost, revenue, profit and return on investment.

README.md

modelimpact

This package is intended to help data scientists and decision-makers understand the potential value of churn prediction models depending on how many customers are being targeted by a campaign.

Installation

You can install the development version from GitHub with:

# install.packages("devtools")

devtools::install_github("PeerChristensen/modelimpact")

Functions and parameters

The first three functions aim to provide information about the business impact of using a model and targeting x % of the customer base. These functions accept the following arguments (required ones in bold):

x- a data framefixed_cost- fixed costs (defaults to 0)var_cost- variable costs (defaults to 0)tp_val- true positive value (defaults to 0)prob_col- the variable containing target class probabilitiestruth_colthe variable containing the actual class

profit_thresholds() accepts the following arguments:

x- a data framevar_cost- variable costsprob_accept- Probability of offer being accepted. Defaults to 1.tp_val- The average value of a True Positive.var_costis automatically subtracted.fp_val- The average cost of a False Positive.var_costis automatically subtracted.tn_val- The average cost of a True Negativesfn_val- The average cost of a False Negativesprob_col- The column with probabilities of the event of interesttruth_col- the column with the actual outcome/class. Possible values are ‘Yes’ and ‘No’

# Parameter settings

fixed_cost <- 1000

var_cost <- 100

tp_val <- 2000

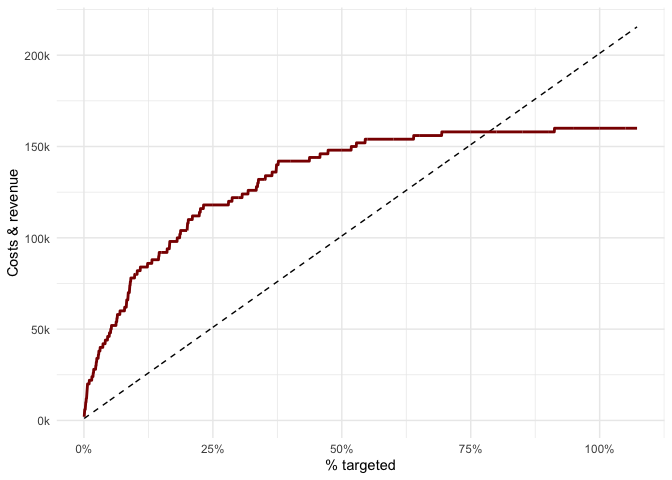

Costs and revenue

library(modelimpact)

library(tidyverse)

library(scales)

head(predictions)

#> # A tibble: 6 x 4

#> predict No Yes Churn

#> <chr> <dbl> <dbl> <chr>

#> 1 No 0.996 0.00353 No

#> 2 No 0.983 0.0166 No

#> 3 No 0.993 0.00705 No

#> 4 No 0.981 0.0187 No

#> 5 No 0.894 0.106 No

#> 6 No 0.997 0.00254 No

cost_rev <- predictions %>%

cost_revenue(

fixed_cost = fixed_cost,

var_cost = var_cost,

tp_val = tp_val,

prob_col = Yes,

truth_col = Churn)

head(cost_rev)

#> # A tibble: 6 x 4

#> row pct cost_sum cum_rev

#> <int> <int> <dbl> <dbl>

#> 1 1 1 1100 2000

#> 2 2 1 1200 4000

#> 3 3 1 1300 6000

#> 4 4 1 1400 6000

#> 5 5 1 1500 6000

#> 6 6 1 1600 8000

# functions for formatting plotting axes

ks <- function (x) { number_format(accuracy = 1,

scale = 1/1000,

suffix = "k",

big.mark = ",")(x) }

pcts <- function (x) { percent_format(scale=1)((x / max(x)) * 100) }

theme_set(theme_minimal())

cost_rev %>%

ggplot() +

geom_line(aes(row,cost_sum), colour ="black",linetype="dashed") +

geom_line(aes(row,cum_rev), colour = "darkred",size=1) +

scale_y_continuous(labels = ks) +

scale_x_continuous(labels = pcts) +

labs(x = "% targeted",y = "Costs & revenue")

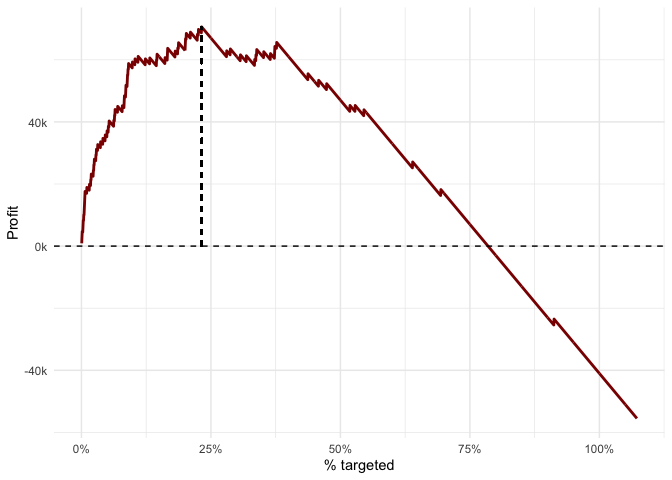

Profit

profit_df <- predictions %>%

profit(

fixed_cost = fixed_cost,

var_cost = var_cost,

tp_val = tp_val,

prob_col = Yes,

truth_col = Churn)

head(profit_df)

#> # A tibble: 6 x 3

#> row pct profit

#> <int> <int> <dbl>

#> 1 1 1 900

#> 2 2 1 2800

#> 3 3 1 4700

#> 4 4 1 4600

#> 5 5 1 4500

#> 6 6 1 6400

# max profit

max_profit <- profit_df %>% filter(profit == max(profit)) %>% select(row,pct,profit)

max_profit

#> # A tibble: 1 x 3

#> row pct profit

#> <int> <int> <dbl>

#> 1 464 22 70600

profit_df %>%

ggplot(aes(x=row,y=profit)) +

geom_line(colour = "darkred",size=1) +

scale_y_continuous(labels = ks) +

geom_segment(x = max_profit$row, y= 0,xend=max_profit$row,

yend = max_profit$profit, colour="black",linetype="dashed") +

geom_hline(yintercept = 0,colour="black", linetype="dashed") +

scale_x_continuous(labels = pcts) +

labs(x = "% targeted",y = "Profit")

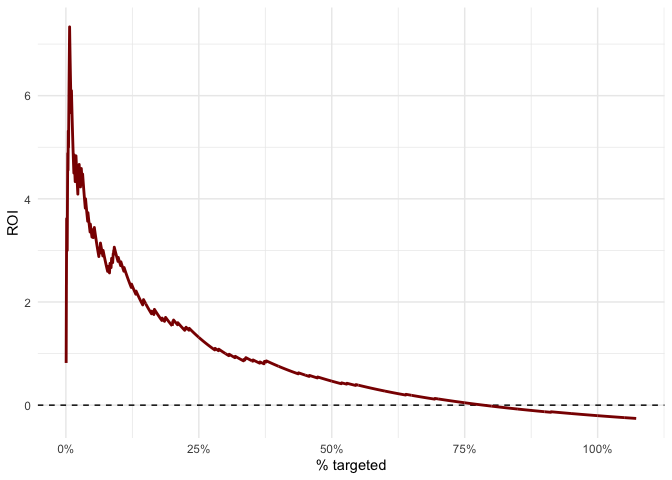

Return on investment

roi_df <- predictions %>%

roi(

fixed_cost = fixed_cost,

var_cost = var_cost,

tp_val = tp_val,

prob_col = Yes,

truth_col = Churn)

head(roi_df)

#> # A tibble: 6 x 5

#> row pct cum_rev cost_sum roi

#> <int> <int> <dbl> <dbl> <dbl>

#> 1 1 1 2000 1100 0.818

#> 2 2 1 4000 1200 2.33

#> 3 3 1 6000 1300 3.62

#> 4 4 1 6000 1400 3.29

#> 5 5 1 6000 1500 3

#> 6 6 1 8000 1600 4

roi_df %>%

ggplot(aes(x=row,y=roi)) +

geom_hline(yintercept = 0,colour="black", linetype="dashed") +

geom_line(colour = "darkred",size=1) +

scale_x_continuous(labels = pcts) +

labs(x = "% targeted",y = "ROI")

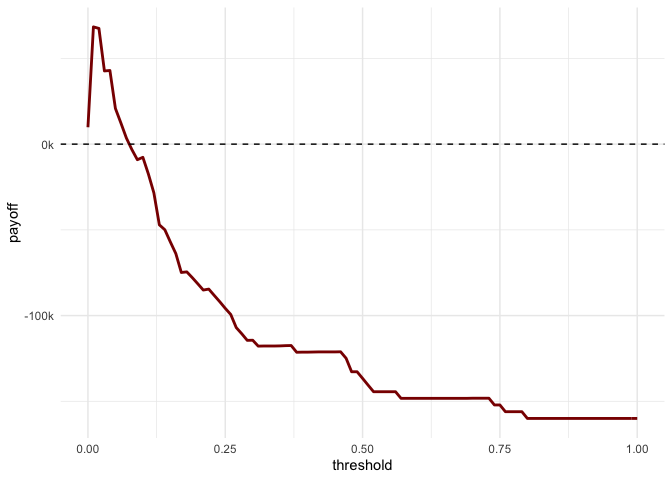

Optimal threshold

thresholds <- predictions %>%

profit_thresholds(var_cost = 100,

prob_accept = .7,

tp_val = 2000,

fp_val = 0,

tn_val = 0,

fn_val = -2000,

prob_col = Yes,

truth_col = Churn)

head(thresholds)

#> # A tibble: 6 x 2

#> threshold payoff

#> <dbl> <dbl>

#> 1 0 9850

#> 2 0.01 68400

#> 3 0.02 67500

#> 4 0.03 42700

#> 5 0.04 42960

#> 6 0.05 20840

optimal_threshold <- thresholds %>% filter(payoff == max(payoff))

optimal_threshold

#> # A tibble: 1 x 2

#> threshold payoff

#> <dbl> <dbl>

#> 1 0.01 68400

thresholds %>%

ggplot(aes(x=threshold,y=payoff)) +

geom_line(color="darkred",size = 1) +

geom_hline(yintercept=0,linetype="dashed") +

scale_y_continuous(labels = ks)