Simple Methods for Calculating and Backtesting Value at Risk and Expected Shortfall.

quarks

The goal of quarks is to enable the user to compute Value at Risk (VaR) and Expected Shortfall (ES) by means of various types of historical simulation. Currently plain historical simulation as well as age-, volatility-weighted- and filtered historical simulation are implemented in quarks. Volatility weighting can be carried out via an exponentially weighted moving average (EWMA) model or other GARCH-type models.

Installation

You can install the released version of quarks from CRAN with:

install.packages("quarks")

Examples

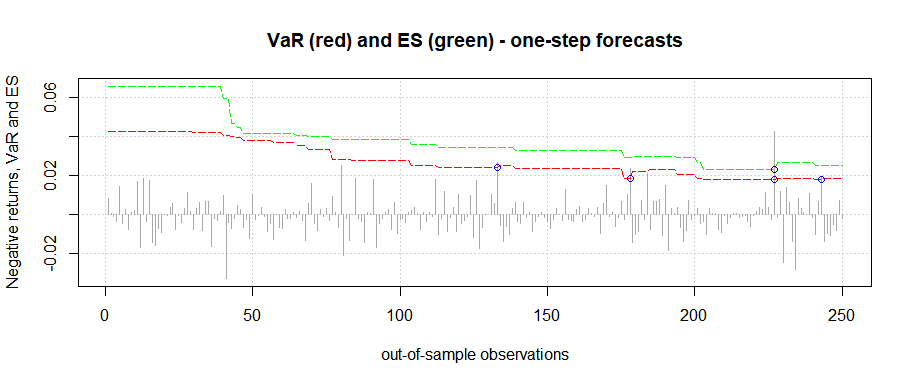

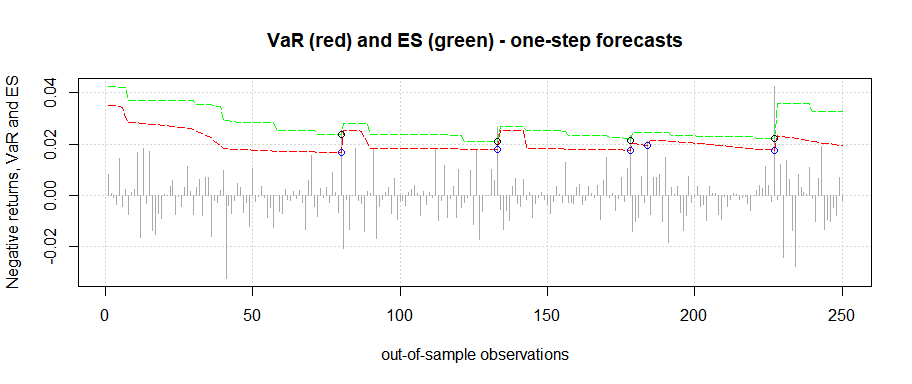

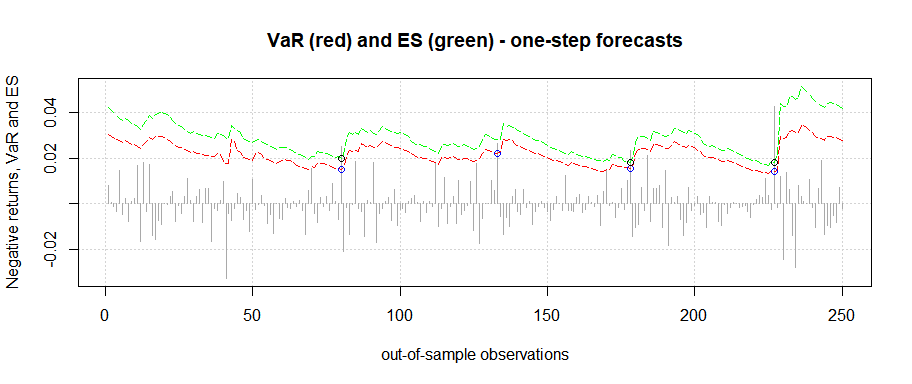

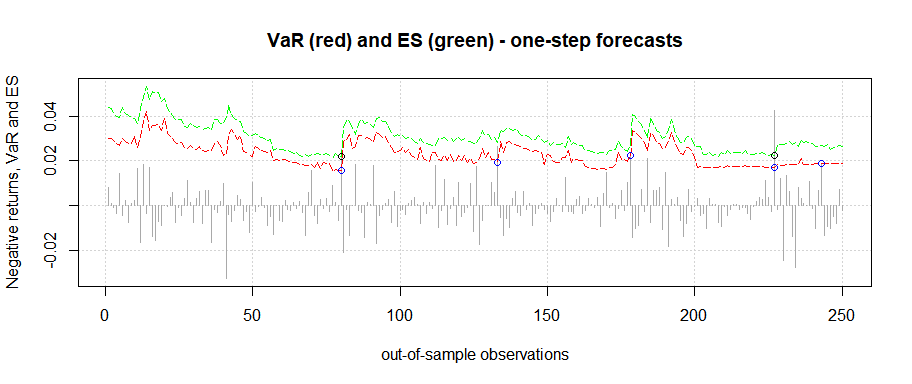

The data set DAX, which is implemented in the quarks package, contains daily financial data of the German stock index DAX from January 2000 to December 2021 (currency in EUR). In the following examples of the (out-of-sample) one-step forecasts of the 97.5-VaR (red line) and the corresponding ES (green line) are illustrated. Exceedances are indicated by the colored circles.

# Calculating the returns

prices <- DAX$price.close

returns <- diff(log(prices))

Example 1 - plain historical simulation

results1 <- rollcast(x = returns, p = 0.975, method = 'plain', nout = 250,

nwin = 250)

#>

#> Calculations completed.

results1

#>

#> --------------------------------------------

#> | Specifications |

#> --------------------------------------------

#> Out-of-sample size: 250

#> Rolling window size: 250

#> Bootstrap sample size: N/A

#> Confidence level: 97.5 %

#> Method: Plain

#> Model: EWMA

#> --------------------------------------------

#> | Forecast performance |

#> --------------------------------------------

#> Out-of-sample losses exceeding VaR

#>

#> Number of breaches: 4

#> --------------------------------------------

#> Out-of-sample losses exceeding ES

#>

#> Number of breaches: 1

#> --------------------------------------------

Visualize your results with the plot method implemented in quarks.

plot(results1)

Example 2 - age weighted historical simulation

results2 <- rollcast(x = returns, p = 0.975, method = 'age', nout = 250,

nwin = 250)

#>

#> Calculations completed.

results2

#>

#> --------------------------------------------

#> | Specifications |

#> --------------------------------------------

#> Out-of-sample size: 250

#> Rolling window size: 250

#> Bootstrap sample size: N/A

#> Confidence level: 97.5 %

#> Method: Age Weighting

#> Model: EWMA

#> --------------------------------------------

#> | Forecast performance |

#> --------------------------------------------

#> Out-of-sample losses exceeding VaR

#>

#> Number of breaches: 5

#> --------------------------------------------

#> Out-of-sample losses exceeding ES

#>

#> Number of breaches: 4

#> --------------------------------------------

plot(results2)

Example 3 - volatility weighted historical simulation - EWMA

results3 <- rollcast(x = returns, p = 0.975, model = 'EWMA',

method = 'vwhs', nout = 250, nwin = 250)

#>

#> Calculations completed.

results3

#>

#> --------------------------------------------

#> | Specifications |

#> --------------------------------------------

#> Out-of-sample size: 250

#> Rolling window size: 250

#> Bootstrap sample size: N/A

#> Confidence level: 97.5 %

#> Method: Volatility Weighting

#> Model: EWMA

#> --------------------------------------------

#> | Forecast performance |

#> --------------------------------------------

#> Out-of-sample losses exceeding VaR

#>

#> Number of breaches: 4

#> --------------------------------------------

#> Out-of-sample losses exceeding ES

#>

#> Number of breaches: 3

#> --------------------------------------------

plot(results3)

Example 4 - filtered historical simulation - GARCH

set.seed(12345)

results4 <- rollcast(x = returns, p = 0.975, model = 'GARCH',

method = 'fhs', nout = 250, nwin = 250, nboot = 10000)

#>

#> Calculations completed.

results4

#>

#> --------------------------------------------

#> | Specifications |

#> --------------------------------------------

#> Out-of-sample size: 250

#> Rolling window size: 250

#> Bootstrap sample size: 10000

#> Confidence level: 97.5 %

#> Method: Filtered

#> Model: sGARCH

#> --------------------------------------------

#> | Forecast performance |

#> --------------------------------------------

#> Out-of-sample losses exceeding VaR

#>

#> Number of breaches: 5

#> --------------------------------------------

#> Out-of-sample losses exceeding ES

#>

#> Number of breaches: 2

#> --------------------------------------------

plot(results4)

To assess the performance of these methods one might apply backtesting.

For instance, by employing the Traffic Light Test, Coverage Tests or by means of Loss Function.

Example 5 - Traffic Light Test

# Calculating the returns

prices <- SP500$price.close

returns <- diff(log(prices))

results <- rollcast(x = returns, p = 0.99, model = 'GARCH',

method = 'vwhs', nout = 250, nwin = 500)

#>

#> Calculations completed.

trftest(results)

#>

#> --------------------------------------------

#> | Traffic Light Test |

#> --------------------------------------------

#> Method: Volatility Weighting

#> Model: sGARCH

#> --------------------------------------------

#> | Traffic light zone boundaries |

#> --------------------------------------------

#> Zone Probability

#> Green zone: p < 95%

#> Yellow zone: 95% <= p < 99.99%

#> Red zone: p >= 99.99%

#> --------------------------------------------

#> | Test result - 99%-VaR |

#> --------------------------------------------

#> Number of violations: 3

#>

#> p = 0.7581: Green zone

#> --------------------------------------------

Example 6 - Coverage Tests

# Calculating the returns

prices <- HSI$price.close

returns <- diff(log(prices))

results <- rollcast(x = returns, p = 0.99, model = 'GARCH',

method = 'vwhs', nout = 250, nwin = 500)

#>

#> Calculations completed.

cvgtest(results, conflvl = 0.95)

#>

#> --------------------------------------------

#> | Test results |

#> --------------------------------------------

#> Method: Volatility Weighting

#> Model: sGARCH

#> --------------------------------------------

#> | Unconditional coverage test |

#> --------------------------------------------

#> H0: w = 0.99

#>

#> p_[uc] = 0.758

#>

#> Decision: Fail to reject H0

#> --------------------------------------------

#> | Independence test |

#> --------------------------------------------

#> H0: w_[00] = w_[10]

#>

#> p_[ind] = 0.0196

#>

#> Decision: Reject H0

#> --------------------------------------------

#> | Conditional coverage test |

#> --------------------------------------------

#> H0: w_[00] = w_[10] = 0.99

#>

#> p_[cc] = 0.0625

#>

#> Decision: Fail to reject H0

#> --------------------------------------------

Example 7 - Loss Functions

# Calculating the returns

prices <- FTSE100$price.close

returns <- diff(log(prices))

results <- rollcast(x = returns, p = 0.99, model = 'GARCH',

method = 'vwhs', nout = 250, nwin = 500)

#>

#> Calculations completed.

lossfun(results)

#>

#> Please note that the following results are multiplied with 10000.

#> $lossfun1

#> [1] 2.27884

#>

#> $lossfun2

#> [1] 10.84525

#>

#> $lossfun3

#> [1] 10.99533

#>

#> $lossfun4

#> [1] 10.2165

Functions

In quarks ten functions are available.

Functions - version 1.1.3:

cvgtest: Applies various coverage tests to Value at Riskewma: Estimates volatility of a return series by means of an exponentially weighted moving averagefhs: Calculates univariate Value at Risk and Expected Shortfall by means of filtered historical simulationhs: Computes Value at Risk and Expected Shortfall by means of plain and age-weighted historical simulationlossfun: Calculates of loss functions of ESplop: Profit & Loss operator function; Calculates weighted portfolio returns or lossesrollcast: Computes rolling one-step-ahead forecasts of Value at Risk and Expected ShortfallrunFTS: Starts a shiny application for downloading data from Yahoo Financetrftest: Applies the Traffic Light Test to Value at Riskvwhs: Calculates univariate Value at Risk and Expected Shortfall by means of volatility weighted historical simulation

For further information on each of the functions, we refer the user to the manual or the package documentation.

Data Sets

DAX: Daily financial time series data of the German Stock Market Index (DAX) from January 2000 to December 2021DJI: Daily financial time series data of the Dow Jones Industrial Average (DJI) from January 2000 to December 2021FTSE100: Daily financial time series data of the Financial Times Stock Exchange Index (FTSE) from January 2000 to December 2021HSI: Daily financial time series data of the Hang Seng Index (HSI) from January 2000 to December 2021NIK225: Daily financial time series data of the Nikkei Heikin Kabuka Index (NIK) from January 2000 to December 2021SP500: Daily financial time series data of Standard and Poor`s (SP500) from January 2000 to December 2021